comblog.ru

Gainers & Losers

How To Start Crypto Mining On My Pc

Technically speaking, any computer can be a bitcoin mining computer. However, if you are asking how to make a EFFICIENT / PROFITABLE bitcoin. You'll first need to acquire an ASIC miner optimized for Bitcoin, such as one produced by Bitmain or Whatsminer. New top-end ASICs start at about $3, to. Step 1 - Create a Wallet · Step 2 - Set up your computer · Step 3 - Install the mining app · Step 4 - Launch the mining app and start mining · Step. Connect your miner and boot it up. Connect your power supply to your ASIC miner, then connect your miner to your router. Use an ethernet cable to connect your. Miners solve complex mathematical problems with sophisticated computers and get rewarded with cryptocurrency. How are mining rewards taxed? If you are mining. NiceHash allows you to earn Bitcoin when you provide idle computing power of your CPU or GPU. To start selling your idle computing power you must use one of. Earn Bitcoin with your PC, GPU & CPU. Start mining the quick way with our world renowned software. There's no easier way to get Bitcoin. learn moreStart mining. You'll need a PC with a powerful GPU as a minimum, but the reality is to be competitive you'll likely need a dedicated Bitcoin mining rig, also known as an ASIC. And it will mine. Try nice hash like others suggest it's the easiest way. But it will be futile. Save up some money buy and asic. You can get an. Technically speaking, any computer can be a bitcoin mining computer. However, if you are asking how to make a EFFICIENT / PROFITABLE bitcoin. You'll first need to acquire an ASIC miner optimized for Bitcoin, such as one produced by Bitmain or Whatsminer. New top-end ASICs start at about $3, to. Step 1 - Create a Wallet · Step 2 - Set up your computer · Step 3 - Install the mining app · Step 4 - Launch the mining app and start mining · Step. Connect your miner and boot it up. Connect your power supply to your ASIC miner, then connect your miner to your router. Use an ethernet cable to connect your. Miners solve complex mathematical problems with sophisticated computers and get rewarded with cryptocurrency. How are mining rewards taxed? If you are mining. NiceHash allows you to earn Bitcoin when you provide idle computing power of your CPU or GPU. To start selling your idle computing power you must use one of. Earn Bitcoin with your PC, GPU & CPU. Start mining the quick way with our world renowned software. There's no easier way to get Bitcoin. learn moreStart mining. You'll need a PC with a powerful GPU as a minimum, but the reality is to be competitive you'll likely need a dedicated Bitcoin mining rig, also known as an ASIC. And it will mine. Try nice hash like others suggest it's the easiest way. But it will be futile. Save up some money buy and asic. You can get an.

Bitcoin mining might have become so competitive that the average Joe can't get a look in - but that doesn't mean it's the case for all cryptocurrencies. There. This is called the Bitcoin blockchain – 2 names for these computers are Bitcoin miners or Bitcoin nodes. They are rewarded for their participation in securing. This is the most dangerous method of mining cryptocurrency with your smartphone. To do that, you need to download sideloading crypto mining apps, bypass the App. Mining cryptocurrencies requires a mining rig (computer), mining software or membership in a mining pool, and a reliable power supply. Here is a step-by-step. It is still possible to participate in Bitcoin mining with a regular at-home personal computer if you have one of the latest and fastest graphics processing. How does mining work? · Specialized computers perform the calculations required to verify and record every new bitcoin transaction and ensure that the blockchain. Can I use Bitcoin mining software on my laptop? Not really. Although some mining software providers claim to support CPU, the reality is that mining Bitcoin. Cudo Miner is packed with features that help you earn as much money as possible from your Laptop or PC. Cudo Miner is easy to install, safe on your hardware. You only need basic PC building skills. ROI is calculated as GPU purchase price/net daily profit. Other GPUs that can build a mining rig include: NVIDIA RTX. To mine one Bitcoin, the cost at 10 cents per kWh is approximately $11,, and at cents per kWh, it's around $5, #5 How does hash rate affect my miner? If you already have a PC, you can follow a fairly straightforward process to start mining right away. To start, you can download one of various crypto mining. You could use a self compiled miner (so hashes don't match known miner software) and use a proxy.. but will likely still get caught and might. To start mining cryptocurrencies, you'll need suitable mining software. Popular options include CGMiner, BFGMiner, and Claymore's Dual Miner. These programs. How to mine crypto · Buy your mining equipment. After you've picked a cryptocurrency, start looking at ASICs or GPUs you can use to mine it. · Set up a crypto. You only need basic PC building skills. ROI is calculated as GPU purchase price/net daily profit. Other GPUs that can build a mining rig include: NVIDIA RTX. Most bitcoin mining software is free and runs on all of the leading operating systems. Computer hardware—commonly known as mining rigs—can be as simple as a. This problem mostly affects computers running Windows. Attack target: Bitcoin Core powers the Bitcoin peer-to-peer network, so people who want to disrupt the. The easiest way to start (though not the hardcore way to run long term) is to sign up at comblog.ru and download their software. This software takes all the. Matters are further complicated by the fact that mining is possible using the CPU and GPU but not with all cryptocurrencies. Rather than trying to install one. Today, mining cryptocurrencies requires a specialized GPU or an application-specific integrated circuit (ASIC) miner. In addition, the GPUs in the mining rig.

Annual Income Required For Mortgage

Need to figure out how much income is required to qualify for a mortgage? Use this mortgage income qualification calculator to determine the required income. Calculate for:*This entry is required. Annual income, Purchase price, Total monthly payment. Annual income. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. Lenders use your gross monthly income before taxes and other deductions as your qualifying income. If you are an hourly full-time employee, lenders will. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and. Need to figure out how much income is required to qualify for a mortgage? Use this mortgage income qualification calculator to determine the required income. Calculate for:*This entry is required. Annual income, Purchase price, Total monthly payment. Annual income. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. Lenders use your gross monthly income before taxes and other deductions as your qualifying income. If you are an hourly full-time employee, lenders will. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and.

Figure out, or have a professional figure out what that number would be. If that number is at or below 50% of your monthly take home wages then. Annual Income. What is your annual pre-tax income? This will be used to * Includes a $0 required monthly mortgage insurance payment. Other Expenses. Annual gross household income* Enter your gross household income $. Include pre-tax income from all applicants. Monthly debt payments* Enter your monthly debt. Using the 28% rule, this household should consider mortgages with a maximum monthly payment amount of $1, You are probably now saying to yourself, that. In other words, if your monthly gross income is $10, or $, annually, your mortgage payment should be $2, or less. $10, X 28% = $2, – maximum. Following this logic, you would need to earn at least $, per year to buy a $, home, which is twice your salary. This is a general guideline, of. Learn what percentage of income is needed for mortgage approval One of the largest and most significant expenses you'll pay each month after purchasing a home. How much house can I afford? Annual Income. $. Monthly Debt. $. Down Payment → The 28 is a recommended DTI ratio for your monthly mortgage payment compared. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. The income required to make the payments each month will vary based on your down payment, interest rate, and other factors, but you're still likely to need an. Your debt-to-income ratio (DTI) would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts. Monthly income. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your estimated debt-to-income ratio. Your monthly payment. Annual income (before taxes) How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Total income needed–the mortgage income calculator looks at all payments associated with the house purchase and then aggregates that as a percentage of income. Generally speaking, mortgage lenders will require you to earn at least £20k but this isn't the case for all. Some lenders may require you to earn more while. If you have a co-borrower who will contribute to the mortgage, combine the total of both incomes to get your annual income. Typically, HOI is required to get. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI.

How To Calculate The Interest Of A Loan

Simple interest is calculated by multiplying loan principal by the interest rate and then by the term of a loan. Simple interest can provide borrowers with a. simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Repay a personal loan in terms of months. Rates range from % to % Annual Percentage Rate (APR)Footnote 4, which includes a relationship discount. When interest is charged monthly, the monthly interest is calculated by dividing the annual interest by In this case that would workout as a monthly. We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is. Simple interest is calculated by multiplying the loan amount with a flat interest rate and a loan tenure. The interest is calculated only on the principal. Annual interest rate for this loan. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current. To calculate the interest due on your loan, please follow the steps below: 1. Obtain the new principal balance of your loan from your Online Banking Account. Simple interest is calculated by multiplying loan principal by the interest rate and then by the term of a loan. Simple interest can provide borrowers with a. simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Repay a personal loan in terms of months. Rates range from % to % Annual Percentage Rate (APR)Footnote 4, which includes a relationship discount. When interest is charged monthly, the monthly interest is calculated by dividing the annual interest by In this case that would workout as a monthly. We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is. Simple interest is calculated by multiplying the loan amount with a flat interest rate and a loan tenure. The interest is calculated only on the principal. Annual interest rate for this loan. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current. To calculate the interest due on your loan, please follow the steps below: 1. Obtain the new principal balance of your loan from your Online Banking Account.

How to Calculate Auto Loan Interest: First Payment Only · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment. Banks most commonly use the / calculation method for commercial loans to standardize the daily interest rates based on a day month. To calculate the. How to Calculate Auto Loan Interest for First Payment · Divide your interest rate by the number of monthly payments you will be making in this year. · Multiply. Interest rate: the cost to borrow money. It is expressed as a percentage of the loan principal. Interest rates can be fixed or variable. APR: the total yearly. The Simple Interest Calculator calculates the interest and end balance based on the simple interest formula. To calculate your monthly interest rate, divide the annual interest rate by For instance, if your annual rate is 5%, your monthly rate is approximately How do lenders calculate interest on a loan? tenure of 20 years/ months and annual ROI of 6% (monthly = ). Using the formula EMI = P * r * (1+r)^n/ (. Interest rate; Number of payments, and; Amount of money you need to borrow (the principal). To calculate any of these items, simply leave. Assuming you pay off the mortgage over the full 30 years, you will pay a total of $, in interest over the life of the loan. That is almost the original. 1. Divide the amount of the additional payment by the amount loaned to determine the simple interest rate. · 2. Calculate the compound interest rate, in which. Simple interest formula. Here is the mathematical formula, on which a simple interest calculator works to compute the loan amount: · A = P (1+RT). To calculate. Interest = interest rate / 12 * starting principal. Principal payment = monthly payment - interest. Ending principal = starting principal -. Interest Rate is the APR from the loan rate chart. · # of Payments is the number of monthly payments you will make to pay off the loan. · Principal is the amount. Interest = A – P. Let's understand the workings of the simple interest calculator with an example. The principal amount is Rs 10,, the rate of interest is When is interest calculated on a home loan? Most banks and lenders calculate interest daily based on the outstanding balance. Interest is then charged on either. How to Calculate Auto Loan Interest: First Payment Only · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment. How to Figure Interest on a Car Loan for First Payment · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by. Interest formula for simple interest: I = Prt where I is the total amount of interest accrued; over t time periods at a simple interest rate, r, and where the. Interest amount = loan amount x interest rate x loan term. Just make sure to convert the interest rate from a percentage to a decimal. For example, let's say. L = loan amount r = interest rate, if floating rn is the interest rate in year n n = tenor of the loan (if the repayment period is 6 months, or 3 months.

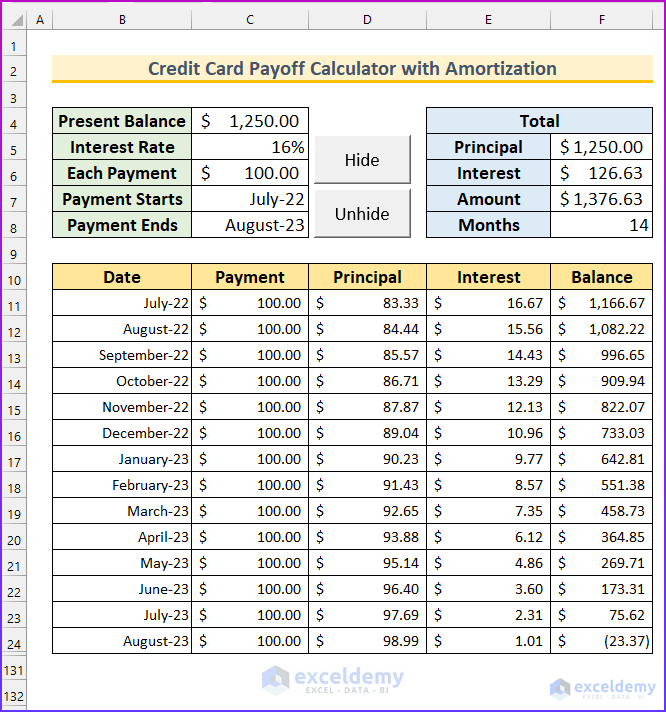

Paying Off Large Credit Card Balance

This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. 1. Get the full picture · 2. Calculate your budget for credit card debt repayment · 3. Prioritize your highest-interest debt · 4. Open a balance transfer credit. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. The fastest way is to pay off the highest-interest debts first while paying the minimum on every other card. Larger debts can be consolidated or transferred to. You'll start by paying the monthly minimums on each of your cards; then, you'll apply any extra to the card with the highest interest rate. Once you pay that. There are multiple ways to approach paying off credit card debts each month. The Credit Cards Payoff Calculator uses a method known as the "Debt Avalanche. The best strategy for paying off credit card debt at the lowest cost is the “avalanche method.” Basically, you start by paying as much as. Start by listing your debts from the highest interest rate to the lowest. You'll still want to make the minimum monthly payment on each balance you have, but. Paying more money toward your highest-interest debts may help you save money in interest payments in the long run. 4. Consolidate credit card debt. Debt. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. 1. Get the full picture · 2. Calculate your budget for credit card debt repayment · 3. Prioritize your highest-interest debt · 4. Open a balance transfer credit. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. The fastest way is to pay off the highest-interest debts first while paying the minimum on every other card. Larger debts can be consolidated or transferred to. You'll start by paying the monthly minimums on each of your cards; then, you'll apply any extra to the card with the highest interest rate. Once you pay that. There are multiple ways to approach paying off credit card debts each month. The Credit Cards Payoff Calculator uses a method known as the "Debt Avalanche. The best strategy for paying off credit card debt at the lowest cost is the “avalanche method.” Basically, you start by paying as much as. Start by listing your debts from the highest interest rate to the lowest. You'll still want to make the minimum monthly payment on each balance you have, but. Paying more money toward your highest-interest debts may help you save money in interest payments in the long run. 4. Consolidate credit card debt. Debt.

Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. If you owe multiple balances, allocate the lion's share of your monthly debt payment to the balance with the highest interest rate, while making the minimum. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card. Make minimum payments on all your debts to avoid late fees and penalties. Then, allocate any extra money you have towards the debt with the highest interest. Generally, it's best to pay off your credit card balance before its due date to avoid interest charges that get tacked onto the balance month to month. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. You will need to have the money so you can. Tips for paying off debt · Pay more than the comblog.ru · Pay more than once a comblog.ru · Pay off your most expensive loan comblog.ru · Consider the. Increase your debt payments: You're also not likely to make progress on a large credit card balance without paying more than the minimum payment. See where you. 10 Tips for Paying Off Credit Card Debt · 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates -- as much. Once that balance is paid off, you divert your extra funds toward paying off the card with the next-highest rate. It can take longer to eliminate balances with. Useful tips · If you have multiple credit cards, focus on paying off the card with the highest interest-rate first. · Take advantage of special offers like 0%. Useful tips · If you have multiple credit cards, focus on paying off the card with the highest interest-rate first. · Take advantage of special offers like 0%. Ways to pay off your credit card debt · 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your. All of these factors make a difference on what your actual monthly payment amount will be, as well as how long it will take you to pay off your total balance. Cut back on your credit cards · Smallest debt. Paying off the card with the smallest debt first helps motivate you to keep going. Once you've paid that off, move. The avalanche method is a money saver. You're paying off the cards with the highest interest rate so in the end, it's not going to cost you as much. The. Say you've accumulated a large balance on a credit card with a high annual percentage rate (APR). If you transfer that balance to a new card with a lower.

The Price Of Palladium Today

With palladium at $ per-ounce, you might pay $ for a 1/oz coin up to 5 coins. If you purchase coins, that price may drop to $ If you buy Palladium price per Gram. $, -$ ↓ ; Palladium price per Ounce. $1,, -$ ↓ ; Palladium price per Kilogram. $35,, -$ ↓. We provide Palladium investors with up to the minute live Palladium spot prices for various Palladium weights including ounces, grams and kilos. Palladium Price Today - Check Palladium Rate in India Today and also know complete info about its commodity price, investment options, and other details. Live Palladium Price - Advanced Chart. Our advanced chart provides multiple tools to analyse the palladium spot price in realtime. You can adjust the settings. Palladium price today, historical prices & chart, and forecast. Learn how and where to safely buy industry-grade palladium. Live Palladium Prices ; PALLADIUM USD/Oz, , ; PALLADIUM GBP/Oz, , ; PALLADIUM EUR/Oz, , Palladium prices today by currency (per gram) ; CHF CHF CHF CHF ; $ $ $ $ Today's palladium price is at $1, per troy ounce. That's up by % from the previous trading day. See the chart below for live and historical prices. With palladium at $ per-ounce, you might pay $ for a 1/oz coin up to 5 coins. If you purchase coins, that price may drop to $ If you buy Palladium price per Gram. $, -$ ↓ ; Palladium price per Ounce. $1,, -$ ↓ ; Palladium price per Kilogram. $35,, -$ ↓. We provide Palladium investors with up to the minute live Palladium spot prices for various Palladium weights including ounces, grams and kilos. Palladium Price Today - Check Palladium Rate in India Today and also know complete info about its commodity price, investment options, and other details. Live Palladium Price - Advanced Chart. Our advanced chart provides multiple tools to analyse the palladium spot price in realtime. You can adjust the settings. Palladium price today, historical prices & chart, and forecast. Learn how and where to safely buy industry-grade palladium. Live Palladium Prices ; PALLADIUM USD/Oz, , ; PALLADIUM GBP/Oz, , ; PALLADIUM EUR/Oz, , Palladium prices today by currency (per gram) ; CHF CHF CHF CHF ; $ $ $ $ Today's palladium price is at $1, per troy ounce. That's up by % from the previous trading day. See the chart below for live and historical prices.

Provident Metals' spot price chart reports the current spot price for one ounce, one gram, and one kilogram of palladium. Palladium current price for 1 ounce is $ as of December 6, Investment is influenced by demand and supply shifts in different markets (commodities. Use the tools and resources below to track the Palladium Price in GBP. Click here to stay updated with the latest gold bullion prices. Ten years ago the spot price of palladium was only around $ and it is now well over $2, Palladium recently hit an all-time high over $3, per ounce. It. 1 Troy Ounce ≈ 0, Kilogram, Palladium Price Per 1 Kilogram, USD ; 1 Troy Ounce ≈ 1, Ounce, Palladium Price Per 1 Ounce, USD. Palladium Prices. Palladium prices averaged USD per troy ounce in August, down % from July. On 30 August, the commodity traded at USD per troy ounce. Spot Palladium Prices Today ; Palladium Price Per Ounce (oz t), $1, ; Palladium Price Per Gram (g), $ ; Palladium Price Per Kilo (kg), $35, Interactive chart of historical daily palladium prices back to The price shown is in U.S. Dollars per troy ounce. The current price of palladium as of. Palladium Spot Price & Charts · Live Metal Spot Price (24hrs) Sep 16, AM ET · Palladium Price Per Ounce · $1, · Palladium Price Per Gram · $ Explore real-time Palladium Futures price data and key metrics crucial for understanding and navigating the Palladium Futures market. The price of palladium has tended to stay between $ and $ USD per ounce for most the past decade, but in 20rose to nearly $ per oz. Palladium prices rose to $ per ounce, marking the highest price in five months, as ETF holdings surged by , ounces this year, largely fueled by. The current Palladium Spot Price is $ per troy ounce. Prices Last Updated: Sep 11, am. - Free Shipping Offer; - Free Shipping Not Available. Palladium Spot Price ; GOLD: $2, + ; SILVER: $ + ; PLATINUM: $1, ; PALLADIUM: $1, Here you will find information on the palladium price per ounce, which adjusts every moment the market is open. Over the past several decades, the palladium. Palladium prices today ; US Dollar (USD), , $1,, $34,, $ ; British Pound (GBP), , £, £26,, £ View intraday palladium bid spot-price charts and historical palladium Be sure to check today's palladium spot price at the top of this page. What. Auto Industry Demand – Much like platinum, the demand from the auto industry is by far the biggest driver of price when it comes to palladium. While platinum is. The chart below allows you to check the price of palladium today or historical prices dating back 20 years. Hover over the chart to see the spot price for that. Palladium price per Gram. $, -$ ↓ ; Palladium price per Ounce. $1,, -$ ↓ ; Palladium price per Kilogram. $35,, -$ ↓.

Do You Need To Carry A Balance To Build Credit

You should not be carrying any balances on any credit cards, ever. What will improve your credit score is on-time payments, credit-to-debt ratio. Your credit card utilization is all about how much you're using of your total available credit. All the gurus say you should keep it at or below 30%. So, if you. Most of the time, paying off your credit card in full is the best approach. CNBC Select explains why and how carrying a balance can harm your financial health. If that amount is greater than 10%, you might have a problem. And you should look into the best way to pay it off quickly and efficiently. When you use credit. If you carry a balance from month to month, the interest rate charged on that balance is one of the key factors to consider in choosing a credit card. Develop a budget and stick to it. · Save money so you're prepared for a rainy day. · Pay your bills on time. · Keep your credit card balances low or aim to pay. Lower credit utilization shows that you're a responsible borrower and you don't have high credit card balances. The key is to keep your balance at or below No, you need not carry a balance or pay interest to build a strong credit score. [1]. You do need to exercise some credit, but you can. Credit cards are great tools for building your credit history, and you don't need to carry an unpaid balance to do so. Your best strategy is to use your credit. You should not be carrying any balances on any credit cards, ever. What will improve your credit score is on-time payments, credit-to-debt ratio. Your credit card utilization is all about how much you're using of your total available credit. All the gurus say you should keep it at or below 30%. So, if you. Most of the time, paying off your credit card in full is the best approach. CNBC Select explains why and how carrying a balance can harm your financial health. If that amount is greater than 10%, you might have a problem. And you should look into the best way to pay it off quickly and efficiently. When you use credit. If you carry a balance from month to month, the interest rate charged on that balance is one of the key factors to consider in choosing a credit card. Develop a budget and stick to it. · Save money so you're prepared for a rainy day. · Pay your bills on time. · Keep your credit card balances low or aim to pay. Lower credit utilization shows that you're a responsible borrower and you don't have high credit card balances. The key is to keep your balance at or below No, you need not carry a balance or pay interest to build a strong credit score. [1]. You do need to exercise some credit, but you can. Credit cards are great tools for building your credit history, and you don't need to carry an unpaid balance to do so. Your best strategy is to use your credit.

Another way to reduce your credit utilization ratio if you're carrying high balances is to bump up your credit limits. For example, if you're carrying $ in. By using your cards and paying the full statement balance each month, you're still demonstrating that you're able to responsibly borrow money. Not to worry if you have debt — it doesn't automatically make you a high-risk borrower. However, as your balances increase so does the probability of difficulty. Ideally, you want a credit utilization ratio of below 10%. First, if you carry a credit card balance from month to month, pay that off asap. The interest rates. Some folks believe you need to carry a balance on your credit card to build good credit. Not true! In fact, carrying a balance can actually hurt your. With the snowball method, you pay off the card with the smallest balance first. Once you've repaid the balance in full, you take the money you were paying for. What is Considered a Good Credit Score? · Open a checking and savings account · Pay bills on time · Pay down outstanding balances · Check credit report yearly. Second, carrying a high balance on your credit card can hurt your credit score. Once you start paying off credit card debt, you free yourself of these potential. To keep your credit card in good standing, pay this amount or the minimum payment listed on the statement. If you pay off the statement balance each month, you. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit. No, you need not carry a balance or pay interest to build a strong credit score. [1]. You do need to exercise some credit, but you can. Carrying a balance doesn't do your credit any favors: It just racks up interest charges. Here's why carrying a card balance to build credit is a myth and. Try never to exceed more than 20–30% of your credit limit. For example, if you have a credit card with a $1, limit, you should carry a balance no greater. Keep an eye on your balances. · Avoid late payment fees by paying on or before the due date. · If possible, pay off your credit card balances in full instead of. It is generally recommended to keep your credit utilization below 30% to maintain a healthy credit score. However, this does not mean you need to carry a. Keep your credit cards active. While credit cards don't require you to carry a balance, if a card is not used for an extended period, the company may. Paying your bill each month helps build a track record of repaying your debt consistently. You can pay the full balance, the minimum payment, or somewhere in. Use each card to your best advantage, make sure to keep your balances low, and if possible, always pay your balances in full on or before the due dates. And, of. Paying your bills on time and in full will have a positive impact on your credit score. And this doesn't only apply to your credit card—you should aim to stay.

Online Savings Account With No Fees

Yes. You can open a Way2Save Savings account without a Wells Fargo checking account. How do I avoid the monthly service fee for Way2Save Savings? How. Explore our highest-yield savings account, with no monthly account fee, no limit to your earnings, and easy mobile and online access. Bask Interest Savings Account is a stand-out option all around, especially for those who prefer fee-free banking. Bask is an online bank that only offers. The Barclays Online Savings Account offers industry-high interest rates (APYs) and secure, 24/7 access to your funds No monthly maintenance fees. No. account access, plus great rates and zero fees - all in one place Fee-free online savings with one of the nation's top savings interest rates. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. Open an online savings account today. Maximize your personal savings with no fees, no minimums, and a competitive high-yield savings rate. American Express savings accounts offer competitive savings rates, no monthly fees, & no minimum balance. Apply for a high yield savings account to earn. Our high-yield online savings account offers a rate competitive with the national average. Open online in under 5 minutes! No fees. No surprises. Yes. You can open a Way2Save Savings account without a Wells Fargo checking account. How do I avoid the monthly service fee for Way2Save Savings? How. Explore our highest-yield savings account, with no monthly account fee, no limit to your earnings, and easy mobile and online access. Bask Interest Savings Account is a stand-out option all around, especially for those who prefer fee-free banking. Bask is an online bank that only offers. The Barclays Online Savings Account offers industry-high interest rates (APYs) and secure, 24/7 access to your funds No monthly maintenance fees. No. account access, plus great rates and zero fees - all in one place Fee-free online savings with one of the nation's top savings interest rates. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. Open an online savings account today. Maximize your personal savings with no fees, no minimums, and a competitive high-yield savings rate. American Express savings accounts offer competitive savings rates, no monthly fees, & no minimum balance. Apply for a high yield savings account to earn. Our high-yield online savings account offers a rate competitive with the national average. Open online in under 5 minutes! No fees. No surprises.

Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. That's why Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Traditional banks charged $11 Billion in. Enjoy a waived Monthly Fee when you have any Santander checking account. Bank branch and the Santander® Savings account can be opened online. Santander. No monthly account fees and no minimum balance requirement. Competitive Rates. Earn % APY. There is no minimum deposit requirement to open the LevelUp Savings account. The account has no monthly fees. Savers will earn a highly competitive APY with. Interest over 5x the National Savings Average Opens modal dialog · No minimum balance requirement · No monthly fees or hidden penalties. Build your savings with a high yield savings account (HYSA) from SoFi and earn a high APY. Open your account online with no minimums and no fees. CIT Bank is the online division of First Citizens Bank. It offers three types of savings accounts. The Platinum Savings account doesn't charge a monthly. You can open a First Citizens savings account online with no monthly fee. To get started, we'll ask you for some personal details and guide you through making. Get a competitive rate with a Savings Connect account and the benefits of easy access to your funds. There is no minimum account balance required to earn a. Backed by the financial expertise of Goldman Sachs. No Fees. No Minimum Deposit. Same-day transfers of $, or less to/from other banks. Along with a competitive, variable rate and no monthly maintenance fees, the Ally Bank Savings Account comes with tools to help grow your money faster. In general, a no-fee savings account works just like a traditional savings account. “One deposits funds into the account; the bank then lends the funds to other. Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ minimum balance · No monthly fee if you. No required minimum balance if you are under 18 years old. No ATM fees at PNC ATMs. Unlimited deposits and up to 6 free withdrawals per month. UFB Direct's savings account rivals competitors in rate, with a % APY. With no minimum deposit requirement and zero monthly fees, this account could be. No monthly fee3. About Savings Accounts. What is an online savings account? Opting for an online savings account means all of your account services are online. Offering one of the highest online savings rates around, we also provide full FDIC insurance coverage directly. With technology rivaling any size bank. My Banking Direct High Yield Savings. Best for no monthly fee. APY. View our best rates and open a savings account online in minutes - U.S. Bank. Compare the different types of savings accounts we offer and benefits.

Best Fitness Training Apps

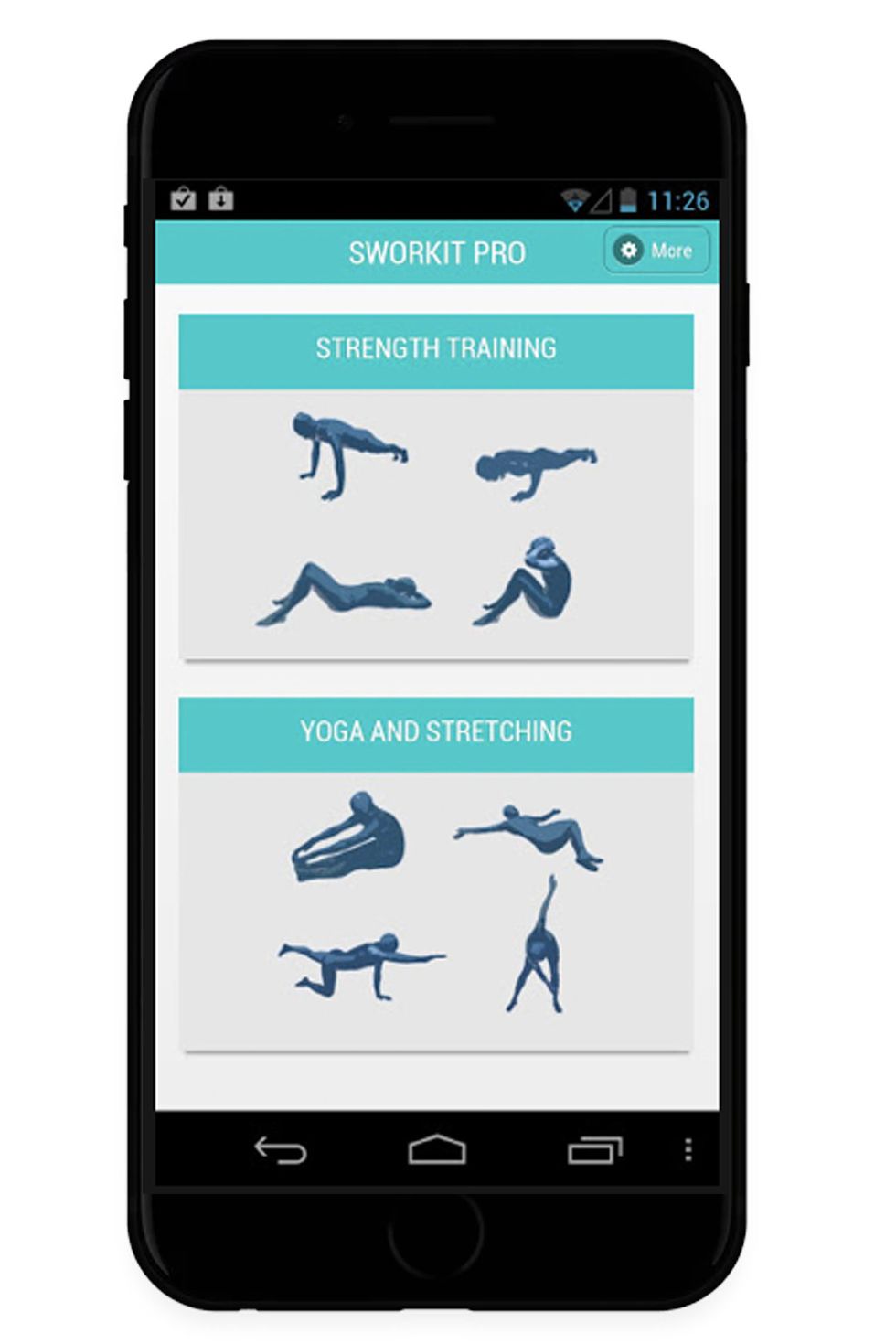

Home Workouts provides daily workout routines for all your main muscle groups. In just a few minutes a day, you can build muscles and keep fitness at home. fitness levels and workout styles. From treadmill workouts to no-equipment strength workouts, our top trainers will keep you motivated in the gym or at home. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT. Work out anywhere, anytime with 50+ programs and + workouts. The Sweat app has transformed the lives of millions of women. Start your free trial today. Transform your fitness journey with JEFIT - the #1 workout tracking app. Track your workouts, monitor your progress, and achieve your fitness goals with. best practice how-to videos, customisable workout routines and wearable integrations. Blockchain. Workout planner and tracker. Enable users to plan workouts. 1. FitOn Workouts & Fitness Plans · 2. Nike Training Club: Fitness · 3. Workout for Women | Weight Loss Fitness App by 7M · 4. Sworkit Fitness –. Kaa-Yaa is one of the best personal trainer apps designed for health-conscious people who cannot take care of their health and fitness due to. Whether you want to strengthen your core, build serious muscle, boost cardio fitness, increase functional strength, try yoga and Pilates, or you're starting. Home Workouts provides daily workout routines for all your main muscle groups. In just a few minutes a day, you can build muscles and keep fitness at home. fitness levels and workout styles. From treadmill workouts to no-equipment strength workouts, our top trainers will keep you motivated in the gym or at home. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT. Work out anywhere, anytime with 50+ programs and + workouts. The Sweat app has transformed the lives of millions of women. Start your free trial today. Transform your fitness journey with JEFIT - the #1 workout tracking app. Track your workouts, monitor your progress, and achieve your fitness goals with. best practice how-to videos, customisable workout routines and wearable integrations. Blockchain. Workout planner and tracker. Enable users to plan workouts. 1. FitOn Workouts & Fitness Plans · 2. Nike Training Club: Fitness · 3. Workout for Women | Weight Loss Fitness App by 7M · 4. Sworkit Fitness –. Kaa-Yaa is one of the best personal trainer apps designed for health-conscious people who cannot take care of their health and fitness due to. Whether you want to strengthen your core, build serious muscle, boost cardio fitness, increase functional strength, try yoga and Pilates, or you're starting.

Top Pick - Boostcamp: comblog.ru #2 - Hevy: comblog.ru #3 - Strong App: comblog.ru #4. Wildly popular as one of the top fitness apps, Sworkit has a wide range of almost million workout exercises. Whether you're a beginner, intermediate or. Fitness Buddy Free – Free, Apple – With more than exercises, detailed descriptions, and animations, the Fitness Buddy app makes strength training easy. You. The Nike Training Club app will make your fitness habits stick with quicker options, goal-setting tools, and new content daily. Best Weightlifting App Overall: Future; Best Weightlifting App for Beginners: Caliber; Best Weightlifting App for Advanced Weightlifters: Boostcamp. List of Top Fitness Apps in · 2. MyFitnessPal. MyFitnessPal is a powerhouse when it comes to tracking your fitness goals. · 3. Caliber. What are the Best Free Fitness Apps in ? This year I asked a personal trainer. NO AFFILIATE LINKS are in this video for best free. Alpha Progression is one of the best muscle-building apps designed for the traditional comblog.ru app comes with a clean interface that's easy to figure out. No equipment needed— unlimited access on any screen. UNLIMITED VARIETY. Get access to world's best workouts from cardio, yoga, strength. Best-known for its at-home indoor cycling classes, Peloton is among the most popular home fitness apps right now. And for those who like to keep a close eye on. BETTER POINTS · Just dance now app screenshot · Fitness RPG app screenshot · Stand up app screenshot · one you couch to 5k app · Daily fitness workout app · Adidas. Gain muscles, endurance, max strength or get toned with Gym Workout Tracker through expertly designed sets, reps and weight! Our routines will adapt to your. Strong is an intuitive, easy to use workout tracker and strength training planner, trusted by more than 3 million people to help them stay on track in the. TrainHeroic brings performance to the people with the leading training app and program marketplace with training plans from real coaches. Workout Planner & Gym Tracker 4+. Weight Lifting & Home Workouts. FITNESS22 LTD · #46 in Health & Fitness. Where the app shines:Freeletics offers a variety of workouts, which can be personally tailored. The workouts are short, challenging and are ideal for training. These Are The Workout Apps 'Women's Health' Editors And Trainers Actually Use · Dani D · Exercise Apps For Women ; The 5 Best Fitness Apps for Working Out at Home. BodyFit by comblog.ru—Gym Workouts & Strength Training Plans. I selected the objective specifically for “muscle building”. The app then gave me several. Best training 'app', hands down From the unique programming, coach engagement, the ladder community, it is one of the best fitness apps I've tried.

Fsa Dental Coverage

.png)

Yes, you can use your HSA (Health Savings Account) funds for dental expenses. This includes preventative care like exams and X-rays, as well as restorative care. How to Use FSA Funds Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. However, eligible expenses include regular cleanings and checkups, as well as a huge slate of potential dental procedures (Internal Revenue Service). While some. FSA and HSA dollars can be used for any medically necessary pediatric dental treatment. This often includes exams, cleanings, fluoride treatments, dental. Unlike a traditional FSA — which can help you pay for a variety of medical costs, including dental and vision — an LP-FSA is intended for just dental and vision. Once you receive dental treatment, pay the bill with the PayFlex. Card®, your account debit card. •. Expense is automatically deducted from your health care FSA. Yes. You can use your health savings account (HSA) and flexible spending account (FSA) for several dental expenses, including fillings and teeth whitening. How to Use FSA Funds. Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. Qualified medical expenses (QMEs) are designated by the IRS and include medical, dental, vision, and prescription expenses. Yes, you can use your HSA (Health Savings Account) funds for dental expenses. This includes preventative care like exams and X-rays, as well as restorative care. How to Use FSA Funds Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. However, eligible expenses include regular cleanings and checkups, as well as a huge slate of potential dental procedures (Internal Revenue Service). While some. FSA and HSA dollars can be used for any medically necessary pediatric dental treatment. This often includes exams, cleanings, fluoride treatments, dental. Unlike a traditional FSA — which can help you pay for a variety of medical costs, including dental and vision — an LP-FSA is intended for just dental and vision. Once you receive dental treatment, pay the bill with the PayFlex. Card®, your account debit card. •. Expense is automatically deducted from your health care FSA. Yes. You can use your health savings account (HSA) and flexible spending account (FSA) for several dental expenses, including fillings and teeth whitening. How to Use FSA Funds. Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. Qualified medical expenses (QMEs) are designated by the IRS and include medical, dental, vision, and prescription expenses.

Getting Dental Care with Your FSA or HSA. Whether you have an FSA, LPFSA, or HSA, you have a great financial tool at your disposal. You've set aside your funds. How Does a Flexible Spending Account Work? · The amount set aside from your pre-taxed income will likely be capped by your employer at $ or less per year. How to Use FSA Funds. Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. You can use your Limited-Purpose FSA to pay for a variety of dental and vision care products and services for you, your spouse, and your dependents. The IRS. FSAs may also be used to cover costs of medical equipment like crutches, supplies like bandages, and diagnostic devices like blood sugar test kits. Get a list. Flexible Spending Accounts allow you to pay for dental care with pre-tax income, saving you money in the long run. Just don't let your benefits expire! Yes. You do not need to be enrolled in a dental plan to have eligible dental expenses reimbursed by your health care flexible spending account. Related. You can use your Health Savings Account (HSA) or Flexible Spending Account (FSA) for dental care. Whether you have dental insurance or are paying out-of-pocket. You can use a limited purpose FSA to pay for vision and dental expenses before you've met your insurance deductible. A type of Health Care FSA that is limited to dental and vision expenses such as: Eyeglasses; Hearing Aids; Teeth cleanings. Covers eligible dependent care. Most dental expenses are covered under the Flexible Spending Accounts many employers are now offering, giving you an extra funding stream for dental care. The U.S. Internal Revenue Service (IRS) issued Publication , Medical and Dental Expenses, which specifically excludes various medical expenses spent on. Shop FSA Eligible Eligible Oral Care Products at CVS Pharmacy like dental guards and mouth sore medications. Grab everything you need with your FSA & HSA. Dental care is eligible for reimbursement with a flexible spending account (FSA), health savings account (HSA), health reimbursement arrangement and limited-. You can use your Limited Expense Health Care FSA (LEX HCFSA) funds to pay for a variety of dental and vision care products and services for you, your spouse. Getting Dental Care with Your FSA or HSA. Whether you have an FSA, LPFSA, or HSA, you have a great financial tool at your disposal. You've set aside your funds. How to Use FSA Funds Patients can use their FSA to cover most dental expenses, including routine care. But not all procedures and treatments are eligible. You can use a Flexible Spending Account to help pay for many of the out-of-pocket expenses that you or your family may incur in dental, or other health care. FSA is not insurance. It is just money. Typically your FSA will give you a debit card that you can pay the provider directly using it. Keep Your Receipts ; Eligible with a detailed receipt, Dental Bridge ; Eligible with a detailed receipt, Dental Denture ; Eligible with a detailed.

Ml Is

-to-Grams-(g)-Step-5-Version-4.jpg)

Machine learning (ML) is the area of computational science that focuses on analyzing and interpreting patterns and structures in data to enable learning. MLlib is Spark's machine learning (ML) library. Its goal is to make practical machine learning scalable and easy. Machine learning is a branch of AI focused on building computer systems that learn from data. The breadth of ML techniques enables software applications to. An Extensible, Fully Customizable Machine Learning Platform. Comet's ML platform is Moving ML Forward and supports productivity, reproducibility, and. From Google: One measuring cup of water is 8 ounces or milliliters (8 ounces multiplied by 30milliliters per 1 ounce equals ml [8 x 30 = ]). This is. More videos on YouTube BigQuery ML lets you create and run machine learning (ML) models by using GoogleSQL queries. It also lets you access Vertex AI models. Machine learning involves systems using structured data to perform tasks without explicit programming. In the realm of workforce management software, ML. Machine learning (ML) is the study of computer algorithms that improve automatically through experience. ML is a subset of artificial intelligence and is. A milliliter measures the capacity of an object or item. One thousand milliliters is equal to one liter. The following unit ratios can be used to convert. Machine learning (ML) is the area of computational science that focuses on analyzing and interpreting patterns and structures in data to enable learning. MLlib is Spark's machine learning (ML) library. Its goal is to make practical machine learning scalable and easy. Machine learning is a branch of AI focused on building computer systems that learn from data. The breadth of ML techniques enables software applications to. An Extensible, Fully Customizable Machine Learning Platform. Comet's ML platform is Moving ML Forward and supports productivity, reproducibility, and. From Google: One measuring cup of water is 8 ounces or milliliters (8 ounces multiplied by 30milliliters per 1 ounce equals ml [8 x 30 = ]). This is. More videos on YouTube BigQuery ML lets you create and run machine learning (ML) models by using GoogleSQL queries. It also lets you access Vertex AI models. Machine learning involves systems using structured data to perform tasks without explicit programming. In the realm of workforce management software, ML. Machine learning (ML) is the study of computer algorithms that improve automatically through experience. ML is a subset of artificial intelligence and is. A milliliter measures the capacity of an object or item. One thousand milliliters is equal to one liter. The following unit ratios can be used to convert.

Machine learning, often abbreviated as ML, is a subset of artificial intelligence (AI) that focuses on the development of computer algorithms that improve. Water has a density of 1 g/ml, so the conversion is 1 gram to 1 millileter, which is equivalent to teaspoons. For other substances, the density will be. What is machine learning? What is ML vs. AI? What data problems could ML solve for your organization? How does it improve security? Let's explore the key. Snowpark ML (the snowflake-ml-python Python package) is the component of Snowflake ML that provides Python APIs for the various Snowflake ML workflow components. Machine learning (ML) is one among many other branches of AI. ML is the science of developing algorithms and statistical models that computer systems use to. There is 1 liter in milliliters. A milliliter (ml) is part of the International System of Units (SI). A liter (l) is the base unit of capacity defined. In this blog post, we will explore how Covidence is harnessing the power of Machine Learning (ML) to enhance the systematic review workflow. What does the abbreviation ML stand for? Meaning: milliliter. Convert grams to milliliters to grams. g to ml to g, density converter, calculator, tool online. Formula and explanation, conversion. ML in PL Conference is an event focused on the best of Machine Learning both in academia and in business. comblog.ru is a free, open-source, and cross-platform machine learning framework, created by Microsoft, for comblog.ru developer platform. ml. The ml stands for milliliter. The abbreviation ml is typically pronounced M-L (saying the letters out loud) or milliliter. This one is nice to remember. Machine learning (ML) is a statistical approach to studying and making inferences about data that utilizes a variety of algorithms suited for answering. Artificial intelligence (AI) vs. machine learning (ML) ; What is artificial intelligence (AI)? · Are AI and machine learning the same? · What is machine learning? Where X=Standard ML Standard ML is a functional programming language with type inference and some side-effects. Some of the hard parts of learning Standard ML. Measurement · Megalitre or megaliter (ML, Ml, or Mℓ), a unit of volume · Millilitre or milliliter (mL, ml, or mℓ), a unit of volume · Millilambert (mL), a non-. 6 meanings: 1. millilitre 2. mile Mali → a landlocked republic in West Africa: conquered by the French by and incorporated. The Machine Learning Exploration Program is intended for startups that are interested in learning more about machine learning (ML) and how it can directly. What is machine learning? What is ML vs. AI? What data problems could ML solve for your organization? How does it improve security? Let's explore the key. Convert ounces to milliliters and millilitres to ounces using this volume conversion tool.

1 2 3 4 5 6