comblog.ru

News

When To Open A Brokerage Account

Steps Required To Open an Online Brokerage Account · Evaluate how a brokerage can help you manage risk · Choose an online brokerage firm · Apply for an account. Opening a brokerage account enables you to trade and invest in stocks, ETFs (exchange-traded funds), bonds, and more. Learn about what a brokerage account. Brokerage accounts allow investors to buy and sell numerous types of investments. When opening a brokerage account, investors have two main options: a cash. Opening a brokerage account requires some research on the part of the club. There are three types of brokerage accounts that have distinct structural. A simple, low-cost way to invest. With Schwab Stock Slices™, you can invest in America's leading companies in the S&P ® for as little as $5, even if their. Is an IRA a Brokerage Account? No. Brokerage accounts are distinct from IRAs in several ways. For example, some brokerage accounts may not charge fees to open. When you open a brokerage account, you need to choose between an individual or joint brokerage account. Joint brokerage accounts are beneficial if you're. It all starts with $0 commissions for online US-listed stock, ETF, mutual fund, and options trades.1 And there are no account minimums or maintenance fees. There is no account fee to own a TIAA brokerage account; however, brokerage transaction fees may apply. In addition, investors are subject to the underlying. Steps Required To Open an Online Brokerage Account · Evaluate how a brokerage can help you manage risk · Choose an online brokerage firm · Apply for an account. Opening a brokerage account enables you to trade and invest in stocks, ETFs (exchange-traded funds), bonds, and more. Learn about what a brokerage account. Brokerage accounts allow investors to buy and sell numerous types of investments. When opening a brokerage account, investors have two main options: a cash. Opening a brokerage account requires some research on the part of the club. There are three types of brokerage accounts that have distinct structural. A simple, low-cost way to invest. With Schwab Stock Slices™, you can invest in America's leading companies in the S&P ® for as little as $5, even if their. Is an IRA a Brokerage Account? No. Brokerage accounts are distinct from IRAs in several ways. For example, some brokerage accounts may not charge fees to open. When you open a brokerage account, you need to choose between an individual or joint brokerage account. Joint brokerage accounts are beneficial if you're. It all starts with $0 commissions for online US-listed stock, ETF, mutual fund, and options trades.1 And there are no account minimums or maintenance fees. There is no account fee to own a TIAA brokerage account; however, brokerage transaction fees may apply. In addition, investors are subject to the underlying.

Open a brokerage account with J.P. Morgan Wealth Management. Access thousands of investments including stocks, ETFs, mutual funds and options. Save money with. All investors enjoy commission-free trading on stocks and ETFs online. Representative-assisted trades are just $ per trade for customers who qualify for the. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. If you are looking to open a brokerage account and find stocks and shares to invest in, make sure you are using a real stockbroker and not a CFD provider. A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. First, you'll need to choose a brokerage where you want to open the account. As we mentioned before, keep in mind fees, perks, and your own investment style. You may also be able to fund your account with a debit card. Keep in mind that some brokerage accounts and/or investments have minimum investment requirements. Why investing shouldn't just be about retirement A brokerage account can be one part of achieving your financial objectives. A solid financial future should. You can open the following product/account types or convert existing accounts to Merrill Guided Investing: Individual, Joint and Custodial (UTMA/UGMA) brokerage. Most brokerage firms allow prospective customers to open an account online or in person. Opening a brokerage account generally requires some personal. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. How to open a brokerage account · 1. Decide whether you want to trade or invest. Choose whether you'd like to trade or invest. · 2. Understand the charges and. Most brokers don't have minimum deposit requirements for opening an account. You may, however, have to reach a minimum to make investments, such as purchasing a. The ideal time for opening a brokerage account will differ based on your goals, financial circumstances, and market state. 1. Alternatively, opening a margin account will allow you to borrow money from the brokerage firm to buy securities and will require that you pay interest on that. Open an account. Fortunately, setting up a brokerage account is the easiest part of the whole process. Once you've decided on a brokerage firm, the online. This course shows you how to choose the right account for you and how you can open one today. Once you open an account, you'll need to know how to use it to. A brokerage account is an essential tool for investors, providing access to a wide range of investment opportunities, including stocks, bonds, mutual funds and. The Fidelity Account®. This full-featured, low-cost brokerage account can meet your needs as you grow as an investor. Open a brokerage account. Reasons to. Brokerage accounts · What is a brokerage account? A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks.

Using Heloc To Buy Another Property

Using a HELOC to purchase another property can be a great way to leverage the value of your current home to purchase a second property. But be sure to research. Once you generate enough equity with your primary property, you can use that equity to finance the down payment for another purchase of a rental home or unit. Yes. Heloc is great during times with higher interest. · A heloc can be renewed, it's best to work with a bank that finances your previous. The Approval Process to Buy a House. A first lien HELOC offers a flexible means for a borrower to purchase a new home or real estate. Both have credit limits. HELOC is also known as a Home Equity Line of Credit. A HELOC is a second mortgage on a rental property that works similar to the way a credit card does. Funds. Coming up with the cash for a down payment on a second home may be an obstacle that is easily overcome. A home equity loan or home equity line of credit (HELOC). Take the first step toward buying a second home. Get approved with Rocket Mortgage® and start house hunting sooner. Start My Approval. If you have a large amount of equity in your first home, you could obtain enough money through a Home Equity Loan to pay for most—if not all—of the cost of a. Legally you can absolutely use a HELOC for this purpose. Might not be the best rate or way to finance a property, but legally you can. Using a HELOC to purchase another property can be a great way to leverage the value of your current home to purchase a second property. But be sure to research. Once you generate enough equity with your primary property, you can use that equity to finance the down payment for another purchase of a rental home or unit. Yes. Heloc is great during times with higher interest. · A heloc can be renewed, it's best to work with a bank that finances your previous. The Approval Process to Buy a House. A first lien HELOC offers a flexible means for a borrower to purchase a new home or real estate. Both have credit limits. HELOC is also known as a Home Equity Line of Credit. A HELOC is a second mortgage on a rental property that works similar to the way a credit card does. Funds. Coming up with the cash for a down payment on a second home may be an obstacle that is easily overcome. A home equity loan or home equity line of credit (HELOC). Take the first step toward buying a second home. Get approved with Rocket Mortgage® and start house hunting sooner. Start My Approval. If you have a large amount of equity in your first home, you could obtain enough money through a Home Equity Loan to pay for most—if not all—of the cost of a. Legally you can absolutely use a HELOC for this purpose. Might not be the best rate or way to finance a property, but legally you can.

You can use the equity in your home to purchase an investment property or second home. · Make sure you understand the qualifications for a home equity line of. The short answer is yes, but doing so comes with some risks. Discover whether using a home equity loan to buy another house is right for you. Because a HELOC is readily accessible, it's possible it could help you purchase an investment property quickly and in cash. Then after purchasing the property. Plus, as it is secured by your real estate, you may get the benefit of an interest rate that is lower when compared to unsecured credit interest rates. What is. A home equity line of credit (HELOC) can be used for any type of purchase, including buying a second home or investment property. If you do not have the cash on. The Risks: Since a Choice Home Equity Line of Credit uses your home as collateral, you will need to consider potential risks: If payments are missed, there is. Coming up with the cash for a down payment on a second home may be an obstacle that is easily overcome. A home equity loan or home equity line of credit (HELOC). A HELOC can be used to buy an investment property. In fact, if you are going to use a HELOC on anything, you might as well put it into a sound investment. If you have enough equity in your home, you can use the money from a home equity loan to buy a second house. However, you should weigh the risks and benefits. A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a second mortgage, it must be paid monthly. A home equity loan essentially allows you to use your original home as collateral, this time to purchase a second property. Yes. You may obtain a HELOC and use the funds as you wish, including a down payment on another property. The lender on your new purchase. The home equity loan often makes sense when using your home's equity to buy another home because you need the funds in one lump sum. In addition, you get a. A home equity loan provides you with a portion of your home's value in the form of cash. Once you receive the funding, you can provide the down payment for the. That's because a line of credit is reusable unlike a home loan. So, if you want to use the funds to remodel your home, help your kids pay for university tuition. A Home Equity Line of Credit (HELOC) is a typical choice for a second priority mortgage. You want to buy a second property. This could be a cottage, a. A popular strategy among homeowners is to use this lump sum to fund the down payment for a second home. In general, you can cash out up to 80% of your home. You can utilise no fixed amount of equity to help you buy a second home. It will depend on your financial situation and proving you can meet the payments. Like a HELOC, in that it's based on available home equity but made to give buyers the capital to carry two mortgages, bridge loans are for those who have good. The loan is repaid in monthly installments over a set term of five to 30 years (similar to your mortgage). Home equity loan rates are typically fixed. A home.

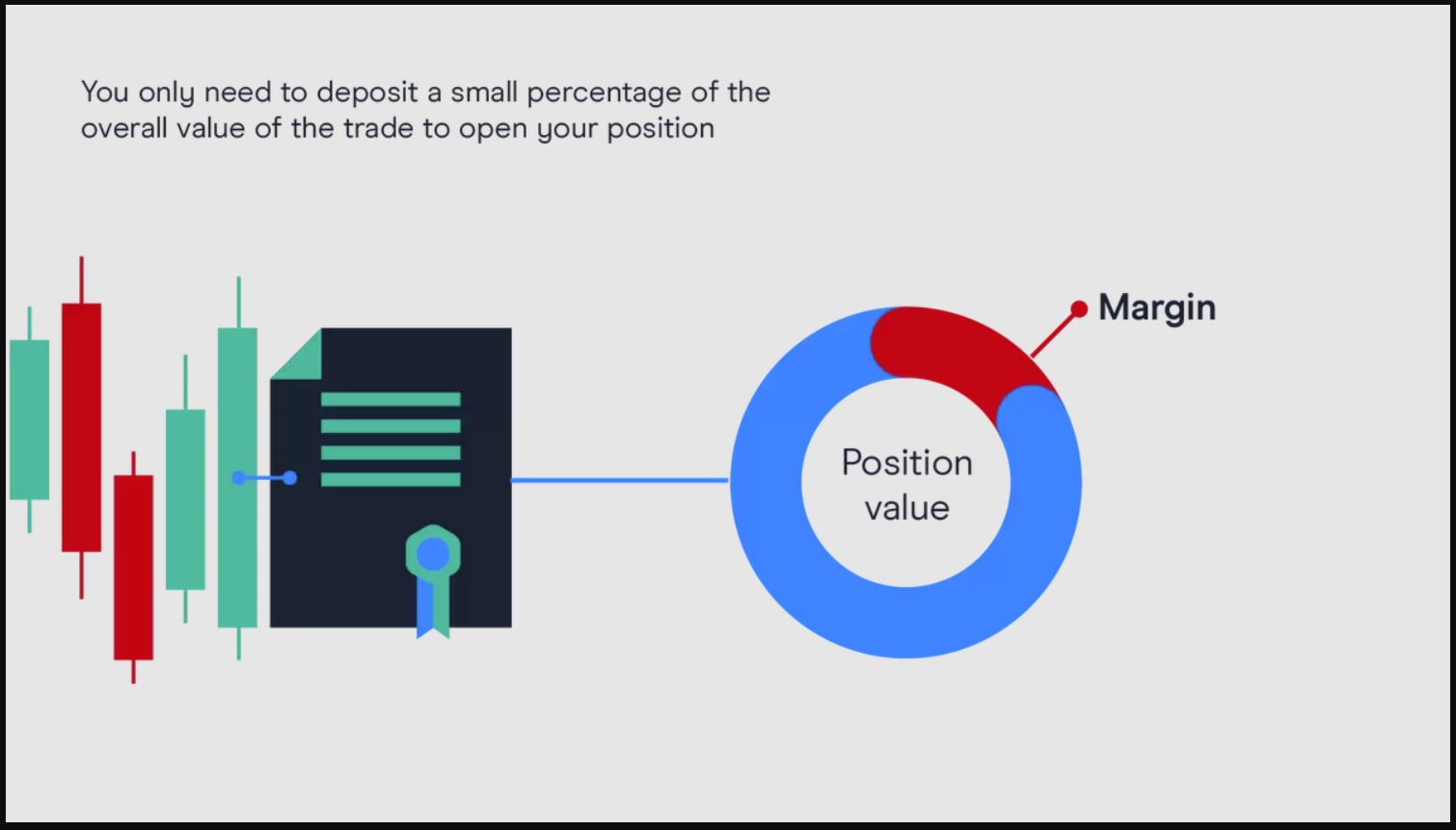

Purchase Stock On Margin

The newly purchased securities are kept in the margin account as collateral until the investor sells the stock and/ or repays the loan, including whatever. Margin investing enables you to borrow money from Robinhood and leverage your holdings to purchase securities. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. A day-trading margin account provides leverage of intraday and overnight buying power on stock trades. For example, if you wanted to purchase 1, For example, if a stock has a margin requirement of 30%, to purchase $ worth of the stock, you would only require $ to make the purchase. The other. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy. Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase securities. In stocks, this can also mean. Buying stocks on margin refers to borrowing money from brokers to buy stocks. Margin loans allow investors to purchase more stock than their buying power. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. The newly purchased securities are kept in the margin account as collateral until the investor sells the stock and/ or repays the loan, including whatever. Margin investing enables you to borrow money from Robinhood and leverage your holdings to purchase securities. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. A day-trading margin account provides leverage of intraday and overnight buying power on stock trades. For example, if you wanted to purchase 1, For example, if a stock has a margin requirement of 30%, to purchase $ worth of the stock, you would only require $ to make the purchase. The other. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy. Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase securities. In stocks, this can also mean. Buying stocks on margin refers to borrowing money from brokers to buy stocks. Margin loans allow investors to purchase more stock than their buying power. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit.

Buying stocks on margin means borrowing funds from your broker to buy more stocks by keeping your existing investments or cash as collateral. You buy stock on. Some securities cannot be purchased on margin, which means the customer must deposit percent of the purchase price in their account. These securities may. When you buy on margin, you're purchasing assets using money that you borrow from your broker. Margin trading might seem more complicated than some other ways. Definition: Buying on margin is borrowing money from a broker to purchase stock. Example: Margin trading allows you to buy more stock than you'd be able to. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. Margin trading: A double-edged sword · The double-edged sword of leverage. Leveraging borrowed funds in a margin account amplifies both gains and losses. · The. With Wells Fargo Advisors, you can buy stocks on margin to extend the financial reach of your account. For more information, contact our investment. There are two margin definitions. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your. When you choose to buy on margin, you simply put the money toward the securities you want. You can see how much buying power you have for stocks and options in. When trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. Margin investing allows you to have more assets available in your account to buy marginable securities. Your buying power consists of your money available to. With margin trading, you borrow cash from your brokerage to buy securities. You also pay margin interest on the loan. With short selling, you borrow securities. When you purchase securities, you may pay for the securities in full, or if your account has been established as a margin account with the margin lending. All securities purchased in a margin account will be automatically paid for from your core position first, followed by any money market. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or. The portion of the purchase cost that you deposit is called "margin". Your credit facility is secured against the purchased securities or other securities held. A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment. Margin buying power is the amount of money an investor has available to buy securities in a margin account.

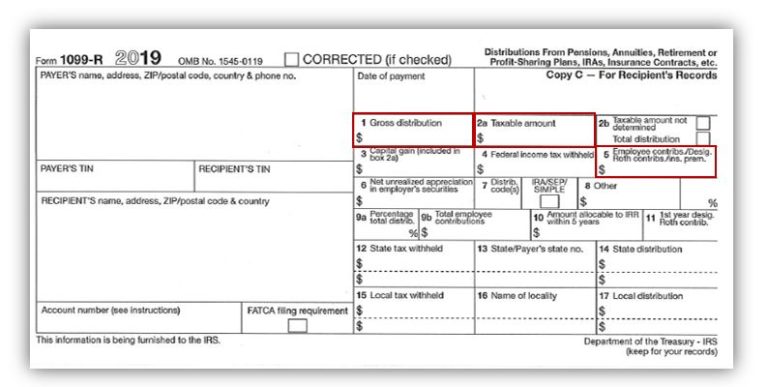

How Gets A 1099

If you've received a Form instead of an employee W-2, your company is treating you as a self-employed worker. This is also known as an independent. Information on how to access your G tax statements for Wisconsin Unemployment Insurance. If you received unemployment, your tax statement is called. A taxpayer might receive a form if they received cash payments or dividends for owning a company's stock. Each type of non-employment income requires a. I just signed up for Quickbooks Payroll, but I'm now realizing I have to be a business to issue a What should I do? Each year, people working as traditional employees receive a W-2, and people working as independent contractors receive a Form MISC as long as their. Who receives a G? We will provide you a Form G if: you deducted your state income taxes on your U.S. Form , Schedule A, for a tax year; and. You'll get a if an organization or business paid you more than a certain amount during the year (generally $ or more) for freelance or self-employed. vendor. Rules & Regulations. Who must file? Persons engaged in a trade or business must file Form MISC when certain payments are made. A. A MISC is a type of tax form. It is used to report miscellaneous income for individuals and companies who have been paid $ or more in non-employee. If you've received a Form instead of an employee W-2, your company is treating you as a self-employed worker. This is also known as an independent. Information on how to access your G tax statements for Wisconsin Unemployment Insurance. If you received unemployment, your tax statement is called. A taxpayer might receive a form if they received cash payments or dividends for owning a company's stock. Each type of non-employment income requires a. I just signed up for Quickbooks Payroll, but I'm now realizing I have to be a business to issue a What should I do? Each year, people working as traditional employees receive a W-2, and people working as independent contractors receive a Form MISC as long as their. Who receives a G? We will provide you a Form G if: you deducted your state income taxes on your U.S. Form , Schedule A, for a tax year; and. You'll get a if an organization or business paid you more than a certain amount during the year (generally $ or more) for freelance or self-employed. vendor. Rules & Regulations. Who must file? Persons engaged in a trade or business must file Form MISC when certain payments are made. A. A MISC is a type of tax form. It is used to report miscellaneous income for individuals and companies who have been paid $ or more in non-employee.

Why did I receive a Form INT from the Department of Revenue? The Internal Revenue Service (IRS) requires the Department to issue Form INT to. A Form MISC is sent to individuals who receive at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. You are likely an independent contractor if you performed work for a business, individual, or any other organization and you received a Form MISC for your. A payee of the Commonwealth of Massachusetts will receive a Form if they received non-employment income from a department or departments of the. A Form NEC reports payments of at least $ in nonemployee compensation, a form often sent to self-employed persons or independent contractors. Form MISC is the exception: paper filed due February 28, electronically filed due March I need a copy of a W2 of filed with Treasury. How can I. Independent contractor tax preparation requires freelancers to get copies of their Form NEC from all of their clients. In addition to employers giving. Your Form G explains how the amount of refund to be reported to the IRS was computed. The following items may increase the refund amount that you are. Taxable payments to employees and students who receive regular payroll checks are reported on form W2 instead of form MISC. Form MISC is also issued to. The IRS Form is used to figure out how much income you received during the year and what kind of income it was. You'll report that income in different. Who Gets a Form? Independent contractors receiving more than $ in nonemployee compensation for business-related services or miscellaneous income. Only taxpayers who receive income other than wages, salaries, or tips reported on a W-2 will get a form. The type of sent depends on the payment. A MISC form is one of many in the series and among those commonly used. Taxpayers receive s, including Form MISC, shortly after the end. Form K is used by third-party settlement organizations (“TPSOs”) to report the payment transactions they process for retailers or other third parties. If. vendor. Rules & Regulations. Who must file? Persons engaged in a trade or business must file Form MISC when certain payments are made. A. Who gets a form? You'll get a form if you're self-employed person, freelancer, or independent contractor who: The deadline to mail it out is January s report income to the IRS. s were designed to increase tax compliance. The Internal Revenue Service (IRS) tracks employee wages and salaries via W-2s. I DIDN'T RECEIVE A G FOR STATE AND LOCAL TAX. REFUNDS. WHY? In order for a state and local tax refund to be considered taxable income for tax year Why did I receive a Form INT from the Department of Revenue? The Internal Revenue Service (IRS) requires the Department to issue Form INT to. receive a INT for each year; The interest must be reported as income on BOTH your federal AND Iowa income tax returns. G. The Department sends a

2 3 4 5 6