comblog.ru

Gainers & Losers

Investvoyager Review

WikiBit: Read our VOYAGER review to learn about the cryptocurrencies offered Start by visiting the Voyager Digital website at comblog.ru You do not need to provide personal information in order to access and view the Voyager website (comblog.ru); however, Voyager may not be able to. We think comblog.ru is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). Reviews: DeFi Lunch (Ep ) - 08/22/22 - @Telegram NFTs on $TON / @SushiSwap Head Chef Plan is bad / @InvestVoyager users clueless / @SamKazemian Goes off! What's the difference between Genesis and Voyager? Compare Genesis vs. Voyager in by cost, reviews, features, integrations, and more. What do you love about the @investvoyager app Head over to the app store to leave us a review & share your favorite features: comblog.ru Voyager Digital they claimed to be a trading exchange for crypto comblog.ru took almost k from me over a year, and then froze the account. As a result of the Voyager + CoinLedger partnership, all Voyager users Reviews · Pricing · Tax Professional Suite. Tools. Crypto Tax Calculator · Crypto. Reviews about the cryptocurrency exchange comblog.ru, a detailed review, the advantages of work, how to deposit and withdraw earnings. WikiBit: Read our VOYAGER review to learn about the cryptocurrencies offered Start by visiting the Voyager Digital website at comblog.ru You do not need to provide personal information in order to access and view the Voyager website (comblog.ru); however, Voyager may not be able to. We think comblog.ru is legit and safe for consumers to access. Scamadviser is an automated algorithm to check if a website is legit and safe (or not). Reviews: DeFi Lunch (Ep ) - 08/22/22 - @Telegram NFTs on $TON / @SushiSwap Head Chef Plan is bad / @InvestVoyager users clueless / @SamKazemian Goes off! What's the difference between Genesis and Voyager? Compare Genesis vs. Voyager in by cost, reviews, features, integrations, and more. What do you love about the @investvoyager app Head over to the app store to leave us a review & share your favorite features: comblog.ru Voyager Digital they claimed to be a trading exchange for crypto comblog.ru took almost k from me over a year, and then froze the account. As a result of the Voyager + CoinLedger partnership, all Voyager users Reviews · Pricing · Tax Professional Suite. Tools. Crypto Tax Calculator · Crypto. Reviews about the cryptocurrency exchange comblog.ru, a detailed review, the advantages of work, how to deposit and withdraw earnings.

Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs It is in joint administration with Voyager Digital Holdings, Inc. www. VOYAGER conducts internal due diligence reviews to determine likely regulatory treatment of digital assets. These reviews may include industry, technological. reviews customers mention when they talk about Changelly, the one who can even convert fiat money into cryptocurrency. Lightning Labs Year of. Reviews: DeFi Lunch (Ep ) - 08/22/22 - @Telegram NFTs on $TON / @SushiSwap Head Chef Plan is bad / @InvestVoyager users clueless / @SamKazemian Goes off! comblog.ru is yet to start collecting reviews. After a review of strategic options, the firm said that comblog.ru The official website of Voyager is comblog.ru You can find their contact. You do not need to provide personal information in order to access and view the Voyager website (comblog.ru); however, Voyager may not be able to. A very honest and comprehensive review of @investvoyager comblog.ru The author is bang on the money. #investvoyager #VGXheroes #VGXshills. general public at comblog.ru (the “Voyager Website”), as well as On July 1, , as part of its review of Voyager's pending application. Please visit us at comblog.ru for more information and to review the latest Corporate Presentation. Neither the Canadian Securities. comblog.ru Review Voyager Token. ×. You need to be logged in to leave a review. star reviews. Do you want buy bitcoin with paypal without id verification or Submit a Review. Name *: Rating *: Review *: comblog.ru Please visit us at comblog.ru for more information and to review the latest Corporate Presentation. Corporate Speaker. Voyager Digital. There are currently no reviews for this Voyager. We believe that behind every review is an experience that matters and we value every feedback. Voyager review: a cryptocurrency broker to buy and trade 60+ digital assets. Earn up to 12% rewards on specific assets. $0 trading fees. comblog.ru I don't want to elevate this into "being discriminated" by some sort of Indian influence, but the one employee review here that. Review your imports on the Transactions page to see the data imported from Voyager during your sync. Transactions labeled Bankruptcy Liquidation and. Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs It is in joint administration with Voyager Digital Holdings, Inc. www. Please visit us at comblog.ru for more information and to review the latest Corporate Presentation. Corporate Speaker. Voyager Digital. Our wallet review process. We examine wallets starting at the code level and comblog.ru"> Copy to clipboard. will show. Contribute.

How Can I Process Credit Card Payments

After initiating a credit card payment, the business sends the cardholder's details to the payment gateway. · The gateway transforms the information in adherence. Credit card payment process. With credit cards, the process is similar, however, there is no issuing bank but rather an issuing card network. There are also. If you want to accept credit card payments, you can do it in one of two ways: merchant accounts or payment service providers. A merchant account is an account. In this guide, we'll walk you through the ins and outs of credit card payment acceptance, from understanding the key concepts to choosing the right solutions. This article covers how to accept credit card payments and the methods you can use to get paid in person, online, and remotely. This guide will walk you through the process, giving you all the information you need to find the right match for your business. comblog.ru supports payment processing by helping small businesses accept credit card and eCheck payments online, in person, via mobile devices. We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. Settlement · The merchant sends their batched approved authorizations to the payment processor. · The payment processor sends the authorizations to the card. After initiating a credit card payment, the business sends the cardholder's details to the payment gateway. · The gateway transforms the information in adherence. Credit card payment process. With credit cards, the process is similar, however, there is no issuing bank but rather an issuing card network. There are also. If you want to accept credit card payments, you can do it in one of two ways: merchant accounts or payment service providers. A merchant account is an account. In this guide, we'll walk you through the ins and outs of credit card payment acceptance, from understanding the key concepts to choosing the right solutions. This article covers how to accept credit card payments and the methods you can use to get paid in person, online, and remotely. This guide will walk you through the process, giving you all the information you need to find the right match for your business. comblog.ru supports payment processing by helping small businesses accept credit card and eCheck payments online, in person, via mobile devices. We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. Settlement · The merchant sends their batched approved authorizations to the payment processor. · The payment processor sends the authorizations to the card.

The Square Reader for contactless and chip accepts EMV chip cards and NFC payments. What is credit card processing? Taking a credit card payment may seem simple. Payment processors are companies that process credit and debit card transactions. Payment processors connect merchants, merchant banks, card networks and others. Credit card processing is what allows businesses to securely accept payments made via credit, debit, gift, and even loyalty cards. Collect credit card payments with MYOB. Whether you're collecting payment at point of sale or sending invoices to your customers, MYOB has you covered. MYOB is. Accept one-time and recurring credit card payments through customizable payment forms, a state-of-the-art Point-of-Sale system, or on a mobile device with the. If you want to accept credit card payments, you can do it in one of two ways: merchant accounts or payment service providers. A merchant account is an account. In the transaction process, a credit card network receives the credit card payment details from the acquiring processor. It forwards the payment authorization. In this blog post, we're going to tell you everything you need to know about accepting credit card payments as a small business. Card details and purchase amount must first be verified and approved by the issuing bank. · The issuing bank checks the validity of the credit or debit card used. Read on for information about how we got here, how a credit card is processed, and industry/legal requirements your business must follow while taking credit. Here's a practical guide that answers the most common questions small business owners have about credit card processing. Credit card processing in 8 simple steps · 1. Making the purchase · 2. Entering the transaction · 3. Transmitting the data · 4. Authorizing the transaction · 5. How to Accept Credit Card Payments: A Small Business Guide Small businesses can accept credit card payments by using an online merchant gateway like Stripe or. Payment processors are companies that process credit and debit card transactions. Payment processors connect merchants, merchant banks, card networks and others. The best way to accept credit card payments depends on your business's needs. The simplest solution is to use a payment service provider that gives you multiple. This is the stage most of us associate with the credit card payment process. It's when the cardholder and the merchant interact—in person, by phone, or online—. Step 1: The customer pays with Mastercard. The customer purchases goods/services from a merchant. Step 2: The payment is authenticated. Generally, payment processors charge a percentage of each transaction, often adding a small per-transaction fee as well, and a few other fees, such as a monthly. If you want to offer this option to your customers, you'll need a card reader with an EMV chip card payment terminal. Note that if you accept in-person payments. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at.

When Do Sole Proprietors File Taxes

As the owner, all decisions and profits are yours, and you alone are responsible for any losses, liability and taxes. do need to register Jane Doe Consulting. You have to file an income tax return if your net earnings from self-employment were $ or more. If your net earnings from self-employment were less than $. You must claim an exemption from the business taxes on the tax return. Filing your Sole Proprietor business tax return should take minutes to complete. Sole Proprietor/Single Member Limited Liability Company (LLC). Sole proprietors and single member LLCs do not file a business Income Tax return. They are. You must claim an exemption from the business taxes on the tax return. Filing your Sole Proprietor business tax return should take minutes to complete. Sole proprietors who do not have employees, who are not required to file sole proprietorship that does not have any of these tax obligations does not. You generally must pay self-employment taxes if you have a profit of $ or more as a sole proprietor or other self-employed person. But as mentioned earlier. Sole proprietorship business owners will file a Federal Schedule C, Profit or Loss From Business, Federal Form , and a Missouri Individual Income Tax Form. Tax obligations of sole proprietorships and self-employed persons file Government Mass Processing Services (in French only) · Access to Information. As the owner, all decisions and profits are yours, and you alone are responsible for any losses, liability and taxes. do need to register Jane Doe Consulting. You have to file an income tax return if your net earnings from self-employment were $ or more. If your net earnings from self-employment were less than $. You must claim an exemption from the business taxes on the tax return. Filing your Sole Proprietor business tax return should take minutes to complete. Sole Proprietor/Single Member Limited Liability Company (LLC). Sole proprietors and single member LLCs do not file a business Income Tax return. They are. You must claim an exemption from the business taxes on the tax return. Filing your Sole Proprietor business tax return should take minutes to complete. Sole proprietors who do not have employees, who are not required to file sole proprietorship that does not have any of these tax obligations does not. You generally must pay self-employment taxes if you have a profit of $ or more as a sole proprietor or other self-employed person. But as mentioned earlier. Sole proprietorship business owners will file a Federal Schedule C, Profit or Loss From Business, Federal Form , and a Missouri Individual Income Tax Form. Tax obligations of sole proprietorships and self-employed persons file Government Mass Processing Services (in French only) · Access to Information.

To file taxes on your sole proprietorship income, you must keep track of a few IRS forms like Form , Schedule C, Form , Form , Form , etc. One of the advantages of a sole proprietorship is its simplicity. You do not separate taxes for your business. You simply report all your business income and. Sole proprietors generally do not have taxes withheld from their income so they usually make quarterly estimated tax payments. The Maryland form for quarterly. Sole proprietors report their business income and losses on their personal tax returns by attaching Schedule C to Form , which keeps the tax process. Sole proprietors do not pay taxes on the full amount of the business's income. Instead, they will only pay a sole proprietorship tax on the profit of the. Sole proprietors do not pay taxes on the full amount of the business's income. Instead, they will only pay a sole proprietorship tax on the profit of the. The tax filing deadline is generally April 15 but can be pushed to the next business day if it falls on a weekend or legal holiday. . Extension request. Filing a personal income tax return. Tax refunds. What if you do not file a return, pay late, or are charged with tax evasion or tax fraud? RRSPs. Q: I want to file as a “Sole Proprietor” but couldn't find the form for a sole proprietor. What form do I use? A: Sole proprietorships are not required to. Sole proprietors claiming a jobs tax credit. Schedule LI, Wisconsin Low-Income Housing Tax Credit. Schedule M, Form 1NPR - Additions to and Subtractions from. The long answer is maybe. The rare exception of not having to file business taxes would apply to those business owners who are self-employed sole proprietors. For federal purposes sole proprietors file Schedule C-EZ, Profit or loss from Business with their personal tax return Form Sole proprietor farmers file. Tax filing can be far simpler for sole proprietorships, especially those with no employees, than for other business legal structures. Q: I want to file as a “Sole Proprietor” but couldn't find the form for a sole proprietor. What form do I use? A: Sole proprietorships are not required to. The department's audit experience shows that most businesses owe use tax but many do not pay use tax. How to Report: Sole proprietors report income and. To file your annual income tax return, you will need to use Schedule C (Form ), Profit or Loss from Business (Sole Proprietorship), to report any income or. How Do I Pay Taxes and File Tax Returns on a Sole Proprietorship? As a sole proprietor, you'll be required to pay quarterly estimated federal taxes four times. A sole proprietor must also obtain a general excise tax. (GET) license, file A partnership must file federal and. Hawaii information returns, but it does not. Entities Not Subject to Franchise Tax. The following entities do not file or pay franchise tax: sole proprietorships (except for single member LLCs);; general. If your sole proprietorship meets any of these requirements, you must submit a Business Tax Application, which you can do on INBiz. This allows the.

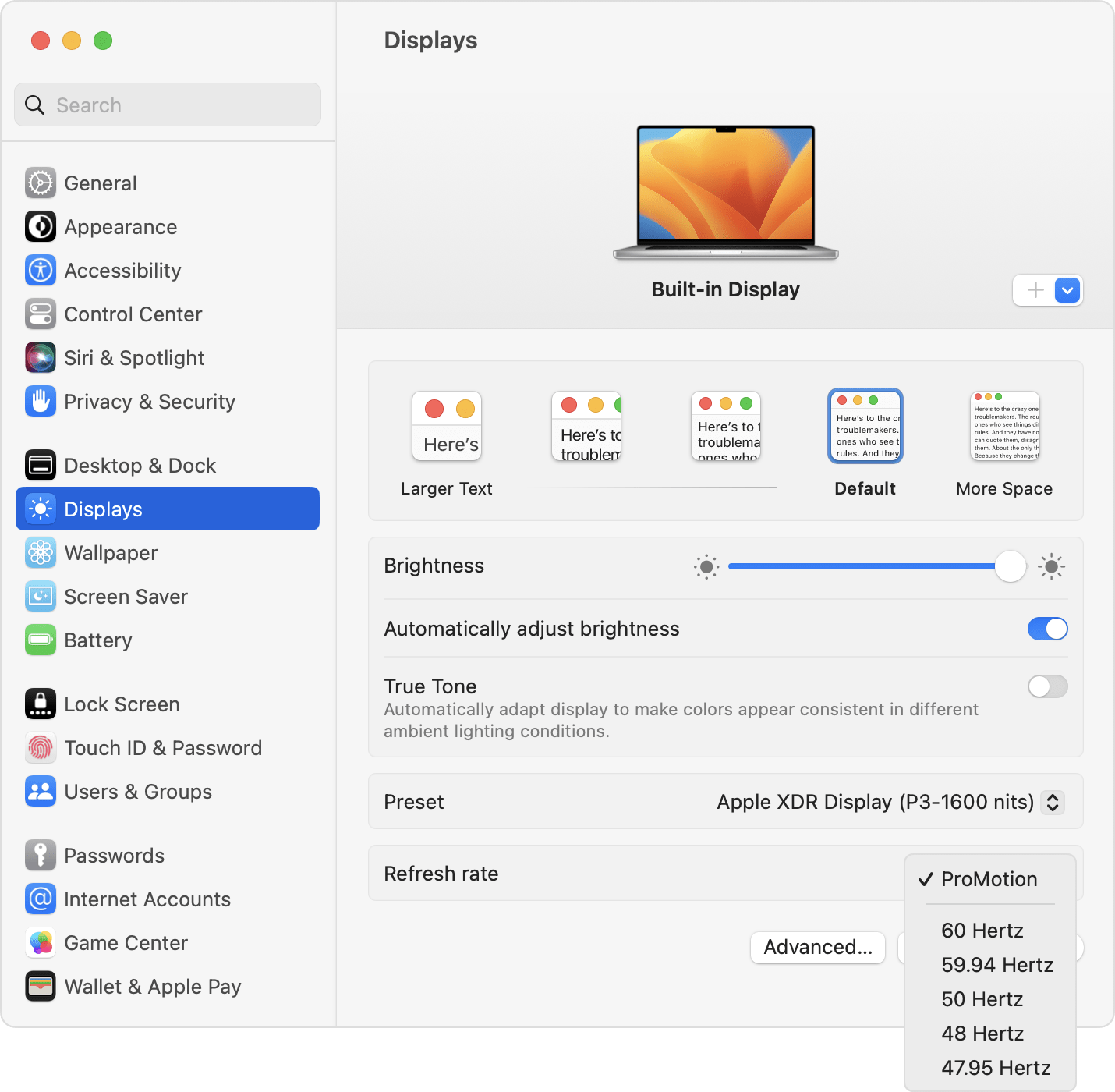

Apple Options

Apple Repair Options · Service and Repair Information · AppleCare Products · Hardware Warranties · Software License Agreements · Complimentary Support. options. More Information about Apple Health. Want more detailed information about Apple Health? You can find it at the Washington State Health Care. Apple Inc. options data by MarketWatch. View AAPL option chain data and pricing information for given maturity periods. If you buy an iPhone, iPad, Mac, or Apple Watch with a trade-in and choose a monthly payment option, your estimated trade-in credit will be applied directly to. The Option key, ⌥, is a modifier key present on Apple keyboards. It is located between the Control key and the Command key on a typical Mac keyboard. Are you trading options on Apple (NASDAQ:AAPL)? View the latest AAPL options chain and put and call options prices at MarketBeat. Apple (AAPL) Options Chain: Get the Latest Information on Strike Prices, Expiration Dates, Premiums, Open Interest, and Implied Volatility. Learn more about popular features and topics, and find resources that will help you with all of your Apple products. Apple Option Chain ; , 0%, ; AAPL Call Exp: Aug 30, Last: Chg.: 0%. SymbolAAPL||C · Delta Imp Vol Bid Apple Repair Options · Service and Repair Information · AppleCare Products · Hardware Warranties · Software License Agreements · Complimentary Support. options. More Information about Apple Health. Want more detailed information about Apple Health? You can find it at the Washington State Health Care. Apple Inc. options data by MarketWatch. View AAPL option chain data and pricing information for given maturity periods. If you buy an iPhone, iPad, Mac, or Apple Watch with a trade-in and choose a monthly payment option, your estimated trade-in credit will be applied directly to. The Option key, ⌥, is a modifier key present on Apple keyboards. It is located between the Control key and the Command key on a typical Mac keyboard. Are you trading options on Apple (NASDAQ:AAPL)? View the latest AAPL options chain and put and call options prices at MarketBeat. Apple (AAPL) Options Chain: Get the Latest Information on Strike Prices, Expiration Dates, Premiums, Open Interest, and Implied Volatility. Learn more about popular features and topics, and find resources that will help you with all of your Apple products. Apple Option Chain ; , 0%, ; AAPL Call Exp: Aug 30, Last: Chg.: 0%. SymbolAAPL||C · Delta Imp Vol Bid

Get hands-on hardware support. Whether you make a Genius Bar reservation, visit an Apple Authorized Service Provider, or mail your device to us, you'll get the. Put Options (expires Friday August 30, ) · AAPL · $ · $ · $ · $ · · · Filter Table By Strike Price of $ View Apple Inc. AAPL stock quote prices, financial information, real options, please see our privacy policy: comblog.ru Cookie. View live Apple Inc chart to track its stock's price action. Find market predictions, AAPL financials and market news. The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the. Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial Options Action · ETF Street · Buffett Archive · Earnings · Trader Talk · Tech. OPTION CHAIN FOR APPLE INC. In-the-money. Show August, Options Hide August, Options. CALLS, PUTS. Expires August 30, Last, Change, Vol, Bid, Ask. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related accessories. Made for Apple · Made for iPad Logi Options+ replaces Options for the products currently supported in Options that are supported by Logi Options+. Apple One bundles your Apple services into one low monthly payment. It's the best way to enjoy Apple Music, Apple TV+, Apple Arcade, iCloud+, and more. Apple Inc. options quotes data for sells and puts, including AAPL last price, change and volume. View a detailed breakdown of listed options for Apple (AAPL). The data is organized by option expiration including implied volatility, option volume. Options for using Windows 11 with Mac® computers with Apple® M1®, M2™, and M3™ chips. Windows 11 runs best on a PC designed for Windows. When such an option. 5x, 1x, 2x, 5x optical zoom options.5x, 1x, 2x, 3x optical zoom options. Adaptive True Tone flash. Adaptive True Tone flash. Photonic Engine. Photonic Engine. Get Options quotes for Apple Inc. (AAPL). Calls and Puts. Strike price, bid, ask, volume, open interest. In the money. Learn about Washington Apple Health (Medicaid) including available Cascade Select (public option) · Clinical collaboration & initiatives · Health. Made for Apple · Made for iPad Logi Options+ replaces Options for the products currently supported in Options that are supported by Logi Options+. Find out more about how Apple Inc option contracts for this week can work for your investing goals. Apple Inc stock options analysis and stock chain. Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial Options Action · ETF Street · Buffett Archive · Earnings · Trader Talk · Tech.

Buy Philippine Stocks

Philippines stocks with the best yearly performance ; SEVN · D · +%, PHP ; BBEL · D · +%, PHP ; AAPX · D · +%, PHP ; GSMI · D · +%. VAT, % (Minimum PHP 24) ; SCCP, % ; BSRD (Bangko Sentral Registration Document) Fee*, PHP (for BUY & SELL trades) ; Stock Transaction Tax, % (for. Welcome to the official website of the PSE — stay updated with the latest market data, stock information, and relevant materials on the Philippine stock. The most conventional way US investors can gain exposure to the Philippine stock market is through American depositary receipts, or ADRs. BPI Trade is the online trading platform of BPI Securities Corporation (BPI Sec). BPI Sec is a trading participant of the Philippine Stock Exchange, Inc. ₱ Blue Chips. Dividend Stocks. REITS. Largest Companies. My Portfolio. All Currencies. All Commodities. Invest Now. #, Asset, Volume, YTD, Div Yield, Price. Up-to-date data on the stock market in Philippines, including leading stocks, large and small cap stocks. BPI Trade is the fully-integrated online trading platform of BPI Securities, the stock brokerage arm of the Bank of the Philippine Islands (BPI). It enables. Stocks can be bought in the Philippines through the PSE. You can opt to buy stocks directly as an investor. You can also opt to invest in instruments like UITFs. Philippines stocks with the best yearly performance ; SEVN · D · +%, PHP ; BBEL · D · +%, PHP ; AAPX · D · +%, PHP ; GSMI · D · +%. VAT, % (Minimum PHP 24) ; SCCP, % ; BSRD (Bangko Sentral Registration Document) Fee*, PHP (for BUY & SELL trades) ; Stock Transaction Tax, % (for. Welcome to the official website of the PSE — stay updated with the latest market data, stock information, and relevant materials on the Philippine stock. The most conventional way US investors can gain exposure to the Philippine stock market is through American depositary receipts, or ADRs. BPI Trade is the online trading platform of BPI Securities Corporation (BPI Sec). BPI Sec is a trading participant of the Philippine Stock Exchange, Inc. ₱ Blue Chips. Dividend Stocks. REITS. Largest Companies. My Portfolio. All Currencies. All Commodities. Invest Now. #, Asset, Volume, YTD, Div Yield, Price. Up-to-date data on the stock market in Philippines, including leading stocks, large and small cap stocks. BPI Trade is the fully-integrated online trading platform of BPI Securities, the stock brokerage arm of the Bank of the Philippine Islands (BPI). It enables. Stocks can be bought in the Philippines through the PSE. You can opt to buy stocks directly as an investor. You can also opt to invest in instruments like UITFs.

Check out this guide if want to learn how to invest in the stock market as a Filipino. Pru Life UK has listed tips to help you. Investing in the Philippine Stock Market is one way to reach your goals financially. You can save money faster, beat inflation and even prepare for. How to Shari'ah-compliantly Invest in the Philippine Stock Market: Beginner's Step-by-Step Guide (Muslim and Money) [Limba, Mansoor] on comblog.ru Invest and trade in the stock market with ease and flexibility Bank of the Philippine Islands. Ayala Triangle Gardens Tower 2, Paseo de Roxas corner. There's no need to be diversified or have lots of different stocks. Just invest in good companies at 50% below their value. Take SCC for example. Based on local recommendations, the seven best shares to buy in the Philippines are detailed below. This discussion is not investment advice. The Philippine Stock Index Fund is a long-term investment outlet that allows you to diversify your money in a mix of domestic stocks. There is a minimum amount you should use to buy an individual stock. The commission charged by BDO Securities to buy a stock is only % or PHP 20, whichever. The stock market is a place where stocks are bought and sold or a place where people can invest in publicly listed companies through the Philippine Stock. Introduction to the Philippine Stock Market The Philippine Stock Investors: Individuals or institutions who buy and sell stocks in the stock. 1. Choose your STOCKBROKER. · 2. Open a TRADING ACCOUNT with your chosen stockbroker. · 3. Discuss with your stockbroker the stocks you wish to BUY or SELL. · 4. Buy PH Stocks via GStocks PH · On your GStocks PH dashboard, tap Buy/Sell · Select the stock you want to buy and tap Buy · Input the desired number of shares and. Maya Stocks is a new investment product in the Maya app that lets you trade • Buy and sell shares of stock from listed Philippine companies • Fund your. Philippine Stock Exchange (PSE), is a marketplace where stocks, bonds, and other securities are bought and sold. It serves as a platform for. List of Philippine Stocks. It includes all listed companies in the Philippines. You can also filter by Blue Chips Only, order by symbol, Share Price. For example, if an investor buys shares of a company's stock for PHP 50 per share and sells them for PHP 70 per share, they will profit PHP 2, Capital. Geared towards a more technology-driven stock market industry, Philstocks Financial, Inc. continuously innovates its products and services to make the stock. STOCKS. CRYPTO. US STOCKS. FOREX. COMMODITIES. GENERAL FINANCE & PASSIVE INCOME Philippine Savings Bank. +%. OPM Oriental Petrol Vol ₱K. The most conventional way U.S. investors can gain exposure to the Philippine stock market is through American depositary receipts, or ADRs. These are the shares. Undervalued Stocks Philippines. ⚫ Final hours! Save up to 50% OFF ++ Trade With A Regulated Broker. Markets. Indices. Commodities. Bonds. Stocks.

Refer To Earn

Purchasing Power's Refer & Earn program allows customers to earn rewards when they refer their co-workers and friends to Purchasing Power. Refer 50 friends, earn free shaving for a year. Referee Rewards: 10% off their first purchase. Results: As the week-long campaign wrapped up, the results. Refer + Earn: Refer a friend to BoxCast and if they become a paid customer, receive a $ credit toward your BoxCast account. *If trading a BoxCaster, please. When you refer a friend to Gusto, you'll receive a gift card on us, and they'll receive a sign-up bonus. Send your referral link to friends. They join with your link and shop. They get an extra 10% Cash Back. You get $30 per friend. After they spend $30 with CenturyLink Refer and Earn. Refer and Earn is a program to refer friends, family or neighbors to CenturyLink internet and earn money. It's free to join and easy. Know someone who wants to work for an industry leader advancing veterinary medicine? Share the joy and refer a friend and earn up to $20, Earn up to $ for every friend you invite to trade with Equiti. Learn more about our tiered reward scheme for traders of all levels and start earning. Refer & Earn is Scoot Education's referral program that educators can earn rewards from! All Scoot substitutes are automatically added to our Refer & Earn. Purchasing Power's Refer & Earn program allows customers to earn rewards when they refer their co-workers and friends to Purchasing Power. Refer 50 friends, earn free shaving for a year. Referee Rewards: 10% off their first purchase. Results: As the week-long campaign wrapped up, the results. Refer + Earn: Refer a friend to BoxCast and if they become a paid customer, receive a $ credit toward your BoxCast account. *If trading a BoxCaster, please. When you refer a friend to Gusto, you'll receive a gift card on us, and they'll receive a sign-up bonus. Send your referral link to friends. They join with your link and shop. They get an extra 10% Cash Back. You get $30 per friend. After they spend $30 with CenturyLink Refer and Earn. Refer and Earn is a program to refer friends, family or neighbors to CenturyLink internet and earn money. It's free to join and easy. Know someone who wants to work for an industry leader advancing veterinary medicine? Share the joy and refer a friend and earn up to $20, Earn up to $ for every friend you invite to trade with Equiti. Learn more about our tiered reward scheme for traders of all levels and start earning. Refer & Earn is Scoot Education's referral program that educators can earn rewards from! All Scoot substitutes are automatically added to our Refer & Earn.

Refer your coworkers to Purchasing Power, and get rewarded! You'll earn savings when their first purchase is made, and so will they. Earn extra when you share your side of the street with a friend! Eligibility. You can start making referrals after just five trips. The driver you refer needs. Get $50 for each friend who opens a qualifying checking account with the link you send them (up to 10 referral bonuses per calendar year). Search All Jobs. Aequor has thousands Healthcare, Schools, Life Science & Technologies Jobs across the country! Refer & Earn. Earn up to $1, each hire. Now it's easier than ever to share why you love Practice Better — and earn a commission whenever someone you refer starts a paid plan. How do I sign up to refer people to Quantum Fiber? You can sign up on the Quantum Fiber Refer and Earn site, review the Program Terms and receive your unique. Perfectlancer Referral Program - Earn money by inviting your friends. We'll give you a unique referral link to share with friends. Every time your referral attends a demo with our team, you earn cash. To earn bill credits for referring businesses to Buckeye Broadband Business, first select the “I am a Business referring a Business” option and then select “. Get paid for sharing the top link building services with your friends & subscribers. Choose between default and percent referral program mode: get $50/per each. Best Referral Programs To Make Money · 1 ShareASale · 2 Fiverr · 3 Payoneer · 4 Revolut · 5 Wise · 6 PayPal · 7 Robinhood · 8 Swagbucks. Refer someone you know and when they sign up for Internet, Cable TV, or Home Phone Services, you'll get a $ credit. On top of that, your referral will get a. Shoppre's referral program offers a chance for each customer to refer a friend or a family member and earn when shopping from India and shipping abroad. Eligible associates may refer candidates for any number of open positions and be eligible to receive bonus payouts for each referral hired. • Referral bonuses. We've designed our Refer A Friend program to reward members like you with $50 each time you refer a new member who opens a Cash-Back Checking. Earn up to $ With PayPal, there's a plus side to everything you do — like earning up to $ cash back (10, points) when you refer. With Notchup you can refer your talented friend and you will get paid when your referral is hired. Refer your friends to Root. When they successfully complete the test drive, you both could get a bonus cash offer. Find your unique referral code in the. Know someone who would make a great substitute educator? Join Scoot's referral program to earn $ for every successful referral. Refer & Earn offer higher returns and can be a perfect option to meet your financial goals. Visit India Bonds to invest online.

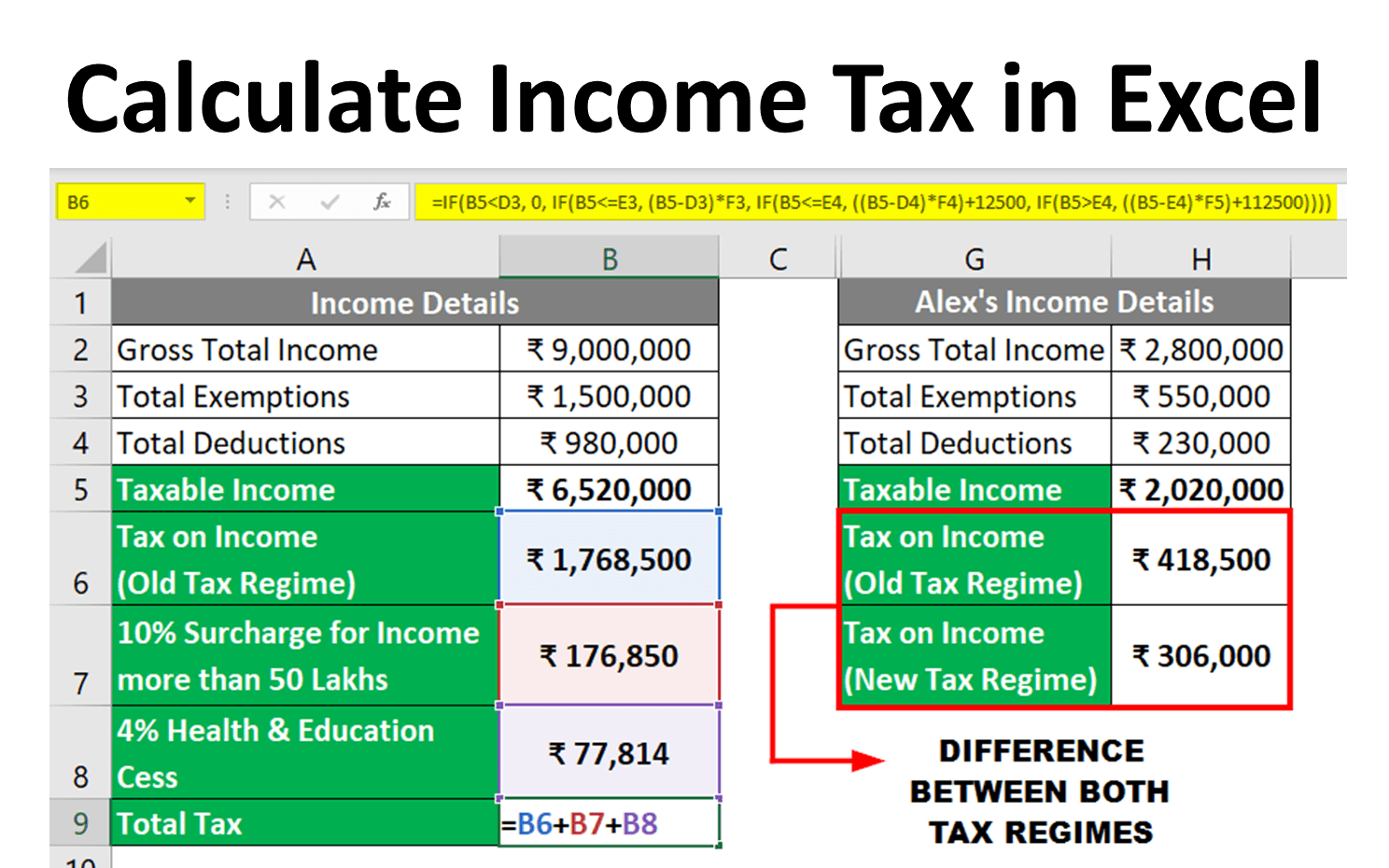

How To Get Income Tax Expense

Tax expenditures describe revenue losses attributable to provisions of Federal tax laws which allow a special exclusion, exemption, or deduction from gross. Under Pennsylvania Earned Income Tax law, all residents of the City of Pittsburgh must have three (3%) percent of their wages withheld from their pay as Earned. Basically, income tax expense is the company's calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the. Some companies report additional items after income tax expense on their income statements. The new principle is used to calculate the current year's amounts. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. explanation of the relationship between tax expense (income) and the tax that would be expected by applying the current tax rate to accounting profit or loss . Income tax expense can be calculated as Earnings before taxes times an effective tax rate. Income tax expense = $10 million x 35% = $ million. The calculation of Income Tax Expense is a straightforward process. It involves multiplying the taxable income of the business by the applicable tax rate. How to calculate the deferred income tax provision. Multiply total taxable temporary differences by the expected tax rate at the time the differences will. Tax expenditures describe revenue losses attributable to provisions of Federal tax laws which allow a special exclusion, exemption, or deduction from gross. Under Pennsylvania Earned Income Tax law, all residents of the City of Pittsburgh must have three (3%) percent of their wages withheld from their pay as Earned. Basically, income tax expense is the company's calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the. Some companies report additional items after income tax expense on their income statements. The new principle is used to calculate the current year's amounts. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. explanation of the relationship between tax expense (income) and the tax that would be expected by applying the current tax rate to accounting profit or loss . Income tax expense can be calculated as Earnings before taxes times an effective tax rate. Income tax expense = $10 million x 35% = $ million. The calculation of Income Tax Expense is a straightforward process. It involves multiplying the taxable income of the business by the applicable tax rate. How to calculate the deferred income tax provision. Multiply total taxable temporary differences by the expected tax rate at the time the differences will.

Try to make the distinction between business expenses from other capital or personal expenses and expenses used to determine the cost of goods sold. Any. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage. The answers that you have highlighted ($42, and $,) are the CURRENT income tax expense. This is the amount that would appear on. You do not need to login to Revenue Online to File a Return. After you file, you have the option of setting up a Login ID and Password to view your income tax. You may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on your Form W-2, Wage and Tax. taxes, charitable contributions, medical and dental expenses, and repayment of claim of right income. Important: to determine the amount of NC itemized. The Illinois Department of Revenue is committed to protecting everyone's tax dollars and wants to make sure we are sending your client the correct refund amount. You'll need to know your filing status, add up all of your sources of income and then subtract any deductions to find your taxable income amount. So, how do you. income tax (income tax provision, income tax expense) that is reported on a regular corporation's income statement. The deduction is based on adjusted gross income and number of exemptions claimed. Taxpayers who keep all their receipts can deduct actual sales tax and use tax. The current income tax expense is calculated by applying the provisions of the IRC to the revenues and expenses for the year. The calculation is required on the. In this company example a small part of the company's total income tax expense for the year, which is based on its taxable income for the year, has not been. You were eligible to claim a credit for child and dependent care expenses on your federal income tax return. You can claim the Virginia deduction even if you. Claiming tax deductible employment expenses. You can claim expenses against your employment income if they're work related and you have to pay for them. Generally, a profitable regular corporation's financial statements will report both income tax expense and a current liability such as income taxes payable. A company's tax expense (or tax charge) is the income before tax multiplied by the appropriate tax rate. Generally, companies report income before tax to. A tax deduction lets you subtract certain expenses from your income before you file taxes. You are then taxed on this lower amount of income instead of the. Pennsylvania Department of Revenue > Tax Types > Personal Income Tax > Unreimbursed Expenses You can claim a deduction for an unreimbursed employee business. "Income tax expense" is what you've calculated that our company owes in taxes based on standard business accounting rules. You report this expense on the income. income tax plus surcharge (if any). Investments / Payments / Incomes on which I can get tax benefit. Section 24 (b) – Deduction from Income from House.

401k Meaning In Us

A (k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute (k) Plan Research: FAQs. Frequently Asked Questions. A (k) is a type of defined contribution retirement plan available to employees of for-profit enterprises extending these retirement options. A (k) plan is a type of retirement savings account. It is a tax-deferred savings pension account frequently offered for employees by employers. This retirement plan allows employees to invest in stocks, bonds, mutual funds, etc. In an EPF, employees contribute a defined share of their salary, and the. The U.S. retirement income system is often described as a "three This means that the enormous expansion of defined contribution plans, especially (k). A (k) is a qualified retirement plan that employers can sponsor for eligible employees to save and invest for their own retirement on a tax-deferred basis. A (k) plan is an employer-sponsored retirement savings plan. It allows workers to invest a portion of their paycheck before taxes are taken out. The Paychex Pooled Employer (k) Plan (PEP) takes the administrative burden off the employer's plate. By pooling assets into one large plan, employers can. A (k) is a tax-advantaged retirement plan that is set up and managed by an employer. Basically, you put money into the (k) where it can be invested and. A (k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute (k) Plan Research: FAQs. Frequently Asked Questions. A (k) is a type of defined contribution retirement plan available to employees of for-profit enterprises extending these retirement options. A (k) plan is a type of retirement savings account. It is a tax-deferred savings pension account frequently offered for employees by employers. This retirement plan allows employees to invest in stocks, bonds, mutual funds, etc. In an EPF, employees contribute a defined share of their salary, and the. The U.S. retirement income system is often described as a "three This means that the enormous expansion of defined contribution plans, especially (k). A (k) is a qualified retirement plan that employers can sponsor for eligible employees to save and invest for their own retirement on a tax-deferred basis. A (k) plan is an employer-sponsored retirement savings plan. It allows workers to invest a portion of their paycheck before taxes are taken out. The Paychex Pooled Employer (k) Plan (PEP) takes the administrative burden off the employer's plate. By pooling assets into one large plan, employers can. A (k) is a tax-advantaged retirement plan that is set up and managed by an employer. Basically, you put money into the (k) where it can be invested and.

What (k) Means. The term “(k)” doesn't carry any hidden meaning. It's simply named after section of the US Internal Revenue Code (IRC), which. (k) contributions are automatically deducted from your paycheck and invested in the plan. Meaning, contributions will come out of your paycheck each pay. A K is a U.S. retirement saving scheme. Collins COBUILD Key Words for Insurance. Copyright © HarperCollins Publishers. The Paychex Pooled Employer (k) Plan (PEP) takes the administrative burden off the employer's plate. By pooling assets into one large plan, employers can. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of the. We empower sponsors, advisors and employers to prepare employees for retirement, offering a variety of retirement plans including Roth (k) and traditional. A (k) is an investment plan sponsored by your employer to help you save for retirement. If you work for a tax-exempt or non-profit organization, or a state. A (k) plan is a qualified retirement plan that's offered by many private-sector employers in the United States. It's named after the section of the Internal. Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the US. In these plans, an employee contributes a portion of. A k is a retirement savings plan funded primarily by employees with pretax earned wages. Employers have the option to contribute to their employees' plans. A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. Examples of defined contribution plans include (k) plans, (b) plans, employee stock ownership plans, and profit-sharing plans. A Simplified Employee. There are a number of types of retirement plans, including the (k) plan and the traditional pension plan, known as a defined benefit plan. The Employee. consists of an employee stock ownership plan (within the meaning of section (e)(7)) or a tax credit employee stock ownership plan (within the meaning of. Almost four decades later, (k) plans have grown to become the most common employer-sponsored defined contribution (DC) retirement plan in the United States. Individuals who want to save for retirement may have the option to invest in a (k) or Roth (k) plan. Both plans are named for the section of the U.S. Financial Well-Being (U.S.) · Education · Starbucks College Achievement Plan This means you own the matching contributions as soon as they are. Capital Group, home of American Funds®, offers a variety of (k) plan solutions and investment options to help employers and plan participants meet their. Capital Group, home of American Funds®, offers a variety of (k) plan solutions and investment options to help employers and plan participants meet their. The Thrift Savings Plan (TSP) is a defined contribution retirement savings and investment plan that offers Federal employees the same type of savings and tax.

Orgreenic Cookware Safety

Orgreenic Frying Pan · Aluminum alloy core provides quick and even heat distribution · Ceramic nonstick interior cooking surface · PTFE and PFOA free. All OrGreenic cookware is durable, dishwasher safe, scratch-resistant, and metal utensil safe. The non-stick coating is Non-Toxic, PTHE, PFOA, and PFOS FREE. Heats Quickly & Versatile - The Orgreenic pans are oven safe up to °F and suitable for all stove types including glass, gas, ceramic, induction, electric. | Heats quickly and oven safe up to F | Metal Utensil Safe! No scratches here | Includes (1) Ceramic Non-Stick 10" Fry Pan with Lid in Hammered Rose Gold |. It is safe to use a pan with a damaged non-stick coating as long as you don't overheat it. If you do, there is a possibility of toxic particles. Bring home your kitchen's new favorite cookware. OrGreenic's cookware sets are non-toxic, non-stick, and are designed to cook every dish evenly. Click the. They're safe. Everybody and their uncle thinks they invented ceramic nonstick coatings, it's no surprise that any given company would go out of. May 18, - Convenient, Easy to Use, Fashionable, Durable, and Safe! LUXURIOUS AND PRACTICAL The Orgreenic hammered collection is beautiful and makes a. It is safe to use a pan with a damaged non-stick coating as long as you don't overheat it. If you do, there is a possibility of toxic particles. Orgreenic Frying Pan · Aluminum alloy core provides quick and even heat distribution · Ceramic nonstick interior cooking surface · PTFE and PFOA free. All OrGreenic cookware is durable, dishwasher safe, scratch-resistant, and metal utensil safe. The non-stick coating is Non-Toxic, PTHE, PFOA, and PFOS FREE. Heats Quickly & Versatile - The Orgreenic pans are oven safe up to °F and suitable for all stove types including glass, gas, ceramic, induction, electric. | Heats quickly and oven safe up to F | Metal Utensil Safe! No scratches here | Includes (1) Ceramic Non-Stick 10" Fry Pan with Lid in Hammered Rose Gold |. It is safe to use a pan with a damaged non-stick coating as long as you don't overheat it. If you do, there is a possibility of toxic particles. Bring home your kitchen's new favorite cookware. OrGreenic's cookware sets are non-toxic, non-stick, and are designed to cook every dish evenly. Click the. They're safe. Everybody and their uncle thinks they invented ceramic nonstick coatings, it's no surprise that any given company would go out of. May 18, - Convenient, Easy to Use, Fashionable, Durable, and Safe! LUXURIOUS AND PRACTICAL The Orgreenic hammered collection is beautiful and makes a. It is safe to use a pan with a damaged non-stick coating as long as you don't overheat it. If you do, there is a possibility of toxic particles.

It turns any kitchen into a culinary masterpiece. The cookware set is lightweight, scratch-resistant, and dishwasher safe, making it easy to handle and clean. No, it is not recommended to use metal utensils with Orgreenic cookware as it may scratch and damage the non-stick coating. It is best to use wooden or silicone. Manufacturer says the nonstick coating does not contain PTFE, a compound made with chemicals that may harm human health and the environment. Orgreenic pans are oven safe up to °F and suitable for all stove types including glass, gas and ceramic – ideal for home chefs who want to explore the. All OrGreenic cookware is durable, dishwasher safe, scratch-resistant, and metal utensil safe. The non-stick coating is Non-Toxic, PTHE, PFOA, and PFOS FREE. Heats Quickly & Versatile - The Orgreenic pans are oven safe up to °F and suitable for all stove types including glass, gas, ceramic, induction, electric. Orgreenic pans have a natural non-stick ceramic surface and are not coated with any potentially hazardous chemicals, but if you want to get the most out of. Luxurious Non-Stick Ceramic 10 Piece White Hammered Cookware Set with Glass Lids, Lightweight,Scratch-Resistant, Dishwasher Safe,Oven Safe up to °F,Suitable. Click here to find a great selection of Dishwasher Safe Cookware from Orgreenic at comblog.ru Don't Just Shop. Q. Heats Quickly & Versatile - The Orgreenic pans are oven safe up to °F and suitable for all stove types including glass, gas, ceramic, induction, electric. Cook healthier meals using these green pans from Orgreenic Kitchenware. safety and ease of use and is oven safe. Lifetime Manufacturer's Warranty. Orgreenic cookware is made with a flat bottom which allows it to be placed evenly over heat source and suitable for all cooking applications for all stove tops. GreenPan GP5 Hard Anodized Healthy Ceramic Nonstick 14 Piece Cookware Pots and Pans Set,Heavy Gauge Scratch Resistant,Stay-Flat Surface, Induction. It's fine to keep a PTFE-coated nonstick pan around for gentle things that are cooked at moderate heat levels. It's used in implants because. OrGREENiC Rose Hammered Cookware Set - Non-Stick Ceramic for Even Heating | Dishwasher, Oven and Stovetop Safe - 22 Piece Set with Lids ; Size. 22 Piece Set with. OrGREENiC nonstick, lightweight, scratch resistant and dishwasher safe! Heats quickly and oven safe up to °F Metal Utensil Safe! No scratches here Includes . pan, 9 inch loaf pan, 12 cups muffin pan. comblog.ru-Toxic - The Orgreenic cookware set is PTHE, PFOA, PFOS, lead. They're safe. Everybody and their uncle thinks they invented ceramic nonstick coatings, it's no surprise that any given company would go out of. Orgreenic cookware is made with a flat bottom which allows it to be placed evenly over heat source and suitable for all cooking applications for all stove tops. Safe - Whether you're cooking on gas, induction, electric, halogen, or ceramic stovetops, the OrGREENiC cookware set is compatible and oven safe up to °F.

What Is A Good Brand Metal Detector

Shop our huge collection of metal detectors from top brands like Garrett, Minelab, Nokta, Fisher, Bounty Hunter, and Teknetics. METAL DETECTION · IQ4 Conveyorized Metal Detector System · IQ4 RUN-WET® Conveyorized Metal Detector · IQ4H Metal Detector · FLEX Conveyor · IQ4 Vertical Fall Metal. Best Metal Detector for Beginners · Garrett AT Pro metal detector (~$) – rugged, light, waterproof and quick to learn. Holds its value well. · Gray Ghost. Metal Detectors · Minelab EQUINOX Multi-IQ Metal Detector with 11" and 6" Coils Complete Package - PKSD · Nokta The Legend SMF Metal Detector Pro Pack w/. Best Overall - XP Deus 2 Waterproof Multi-Frequency Metal Detector; Best Entry Level Detector- Garrett Ace Metal Detector; Best Relic Hunting Detector -. 22 products · Bounty Hunter Pin Pointer Metal Detector. Garrett ACE Apex Metal Detector · $ ; Garrett ACE Apex, Jase Robertson Signature Edition · $ ; Garrett ACE Apex w/ MS-3 Wireless Headphones · $ What is the best metal detector for the UK? · Try and stick with well known established manufacturers, like Garrett, Minelab, Tesoro, Bounty Hunter, White's, XP. Metal Detector Brands · Minelab · Garrett · Nokta · XP · Falcon Metal Detectors · Fisher · Teknetics Metal Detectors · Bounty Hunter Metal Detectors. Shop our huge collection of metal detectors from top brands like Garrett, Minelab, Nokta, Fisher, Bounty Hunter, and Teknetics. METAL DETECTION · IQ4 Conveyorized Metal Detector System · IQ4 RUN-WET® Conveyorized Metal Detector · IQ4H Metal Detector · FLEX Conveyor · IQ4 Vertical Fall Metal. Best Metal Detector for Beginners · Garrett AT Pro metal detector (~$) – rugged, light, waterproof and quick to learn. Holds its value well. · Gray Ghost. Metal Detectors · Minelab EQUINOX Multi-IQ Metal Detector with 11" and 6" Coils Complete Package - PKSD · Nokta The Legend SMF Metal Detector Pro Pack w/. Best Overall - XP Deus 2 Waterproof Multi-Frequency Metal Detector; Best Entry Level Detector- Garrett Ace Metal Detector; Best Relic Hunting Detector -. 22 products · Bounty Hunter Pin Pointer Metal Detector. Garrett ACE Apex Metal Detector · $ ; Garrett ACE Apex, Jase Robertson Signature Edition · $ ; Garrett ACE Apex w/ MS-3 Wireless Headphones · $ What is the best metal detector for the UK? · Try and stick with well known established manufacturers, like Garrett, Minelab, Tesoro, Bounty Hunter, White's, XP. Metal Detector Brands · Minelab · Garrett · Nokta · XP · Falcon Metal Detectors · Fisher · Teknetics Metal Detectors · Bounty Hunter Metal Detectors.

Our collection features waterproof metal detectors from Garrett, Nokta Makro, and Minelab, offering the best durability and technology. Equip yourself with a. Explore our inventory of the top brands in the industry, we are committed to bringing you the best of the best. If you have questions, email or call us! Discover The Best Of Gold & Metal Detectors From Ajax Detection · Ares. Time to go deeper. Ares metal detector Intelligence, quality, Precision, efficiency. The leading brands in the past few years are Minelab, XP and Nokta. Minelab and Nokta have good entry level detectors with modern features. Brands · Aquascan Detectors · Fisher Hobby · Garrett Detectors · Minelab Detectors · Nokta Detectors · Terra Exploration Group · XP Metal Detectors · Fisher Commercial. Best Metal Detector for Beginners · Garrett AT Pro metal detector (~$) – rugged, light, waterproof and quick to learn. Holds its value well. · Gray Ghost. which brand is the best quality security metal detector door? · 1. CEIA from Italy. In recent years, ceia's international market share has been increasing. · 2. I would say the best is the White's i3E. it uses three frequencies to locate, determine depth and identify the material being scanned. the. Top Metal Detector Brands In Our Collection · Minelab: Leading with Innovation for Depth and Precision · XP Deus II: Setting New Standards in Versatility and. MINELAB MANTICORE High-Power Multi-IQ+ Waterproof Metal Detector for Adults with Advanced Target ID (11" Double-D Coil Included) Nokta Simplex Ultra WHP. Our favorite is the Minelab Equinox , in part because of its multiple detection modes and support for multiple frequencies. It's a versatile metal detector. Our collection features waterproof metal detectors from Garrett, Nokta Makro, and Minelab, offering the best durability and technology. Before the List, Do You Know What Makes a Good Gold Metal Detector? · 1. Minelab GPZ · 2. Garrett ATX · 3. Minelab SDC · 4. Minelab Gold Monster · 5. Get the best deal online on a Garrett Metal Detector including the all-new Garrett AT MAX. The Ultimate Guide to Choosing a Good Metal Detector · 1. VLF Detectors: VLF detectors, which stand for "Very Low Frequency detectors," can be used for a wide. Search the most trusted metal detector brands in the industry! Explore our inventory of the top brands in the industry, we are committed to bringing you the. Some popular and highly regarded metal detector brands include Garrett, Minelab, and Fisher. Ultimately, the best metal detector for you will depend on your. Our DeteX Series Metal Detectors are ideal for a variety of industries due to its sensitivity, product storage capacity, flexible design, and washdown rating . The Minelab Vanquish is one of the best beginner metal detectors on the market. Designed for ease of use for those just starting out but with all the. Perhaps you are brand new to metal detecting or you are upgrading your detector. Whichever it is, you may need some help deciding which detector is best for you.

1 2 3 4 5